How to recognize and report a Wells Fargo scam

Scammers sometimes use Wells Fargo’s name to make their messages appear legitimate. A text, call, or email might look official at first glance, but not everything that claims to be from the bank is real. By learning how these scams operate, you can avoid sharing information that puts your accounts at risk. This guide walks you through the signs of a Wells Fargo scam and how to respond safely.

What is a Wells Fargo scam?

Wells Fargo scams are often impersonation schemes. Scammers pretend to represent the bank in order to gain your trust. Their goal is to get you to share personal or financial information that they can use for unauthorized access or identity theft.

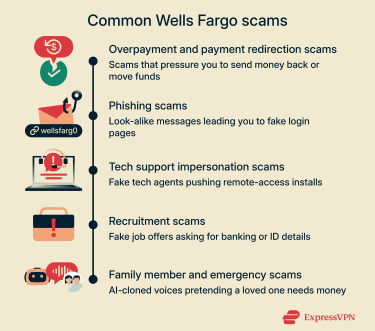

Common types of scams involving Wells Fargo

Scammers frequently impersonate Wells Fargo using different tactics designed to trick customers into sharing personal information or sending money.

Overpayment and payment redirection scams

Online payment scams exploit fast transfer methods like Zelle and wire transfers, where payments may be irreversible once they’re sent. These scams take on many forms, from getting you to buy non-existent goods, to getting you to pay yourself, and redirecting the transfer.

Common examples include:

Fake check overpayment scams

Fake check overpayment scams can come in two forms. One involves someone sending you a counterfeit or stolen check and pressuring you to deposit it. The second is when someone overpays for a purchase and then asks you to return the extra amount.

After you deposit the check, you send back part of the money through a wire transfer, gift card, money order, cryptocurrency, or a payment app like Zelle.

The check may appear to clear at first, but it can take time for Wells Fargo to confirm it is fake. When the check is returned, the full amount is removed from your account, and any money you sent might not be recovered.

Online marketplace seller scams

The scammer gets you to pay for a product or service on a fraudulent website, but never delivers it. This leaves you without the item or your money.

Pay-in-advance scams

Scammers promise you a large payout or reward but ask for an upfront fee. The scammer then disappears.

“Pay yourself” scams

Someone tells you to move money to your own account for protection, but redirects the transfer to an account controlled by the scammer.

Learn more: How to make secure online payments

Phishing scams

In phishing Wells Fargo scams, scammers send you a call, text, or email that appears to be from the company, typically asking you to click on a link or download an attachment in order to “verify” your account, resolve a supposed problem, or take urgent action.

Scammers often use email addresses that look almost identical to the real ones, sometimes changing only a letter or two. They also use unfamiliar phone numbers or spoofed caller IDs to make the contact look legitimate.

Tech support impersonation scams

Wells Fargo tech support scams start with a call, text, or email from a fake tech-support agent pretending to be a Wells Fargo employee. They claim your Wells Fargo account is compromised and offer to help you fix the problem. They may then ask you to install remote-access software, share your login credentials, or send money to cover “repairs” or “security updates.” Once you comply, the scammer can access your device or account and steal your data or funds.

Recruitment scams

Some scammers pose as Wells Fargo recruiters and contact individuals with fake job offers or interview requests. These messages may come through email, text, social media, or job-search platforms and often promise high pay, remote work, or fast hiring with little effort.

During the fake recruitment process, scammers ask for personal information such as Social Security numbers, copies of identification, or banking details, claiming it is needed for background checks, direct deposit, or onboarding. In some cases, victims are even asked to send money for training materials, equipment, or processing fees.

Family member and emergency scams

In this type of scam, someone impersonates a family member or trusted contact and claims there’s an emergency that requires urgent action. Some schemes now use AI-generated voices, images, or videos to sound or look convincing.

The scammer typically asks you to send money quickly or share Wells Fargo account information, relying on fear and urgency to bypass normal caution.

Why scammers target Wells Fargo customers

Wells Fargo is one of the largest banks in the United States, and it serves millions of customers. This large customer base makes it an attractive target for scammers. Even if only a tiny percentage of recipients fall for the scam, the sheer volume of potential victims can potentially generate significant profits.

The bank’s strong brand reputation also plays a role in gaining trust. Victims are more likely to trust messages that appear to come from Wells Fargo, especially urgent alerts about account security.

How big is the problem? Statistics and trends

According to Wells Fargo’s Fraud and Scam Solutions report, scams became the leading form of fraud in 2024, with a 56% year-over-year increase. The report also warns that using artificial intelligence, such as deepfakes, in scams is becoming an increasingly common tactic for scammers.

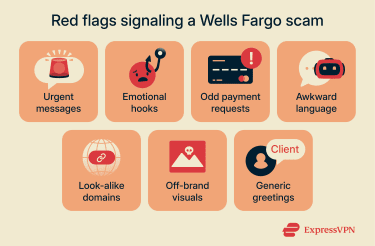

Red flags signaling a Wells Fargo scam

Scammers design their messages to blend in and avoid detection, but there are still warning signs that can reveal a message claiming to be from Wells Fargo is fraudulent.

Urgent messages

Scam messages use time-based threats to force immediate action. For example, they may claim that your account will be locked “within 15 minutes,” that a pending charge must be disputed before a strict deadline, or that access will be suspended if you don’t respond immediately.

Emotional manipulation

Scammers often try to provoke fear, responsibility, or trust to try to influence your decisions. For example, a scam message might suggest you will be held personally liable for unauthorized charges, imply that you failed to secure your account properly, or frame itself as a “helper” offering refunds or credits if you respond.

Unusual payment requests

Requests to send money using gift cards, prepaid cards, cryptocurrency, wire transfers, or using other payment apps are a strong warning sign. Wells Fargo doesn’t require customers to resolve account issues or verify activity using these payment methods.

Awkward or uncharacteristic language

While scammers increasingly use large language models (LLMs) to improve spelling and grammar, messages may still sound slightly unnatural, overly generic, or inconsistent with Wells Fargo’s usual tone. Language that feels “off,” overly formal, or vague, especially when paired with urgency, is a warning sign.

Look-alike domains and links

Scammers often use website links or email addresses that closely resemble Wells Fargo’s official domains but differ by a letter, symbol, or extra word. Always check the full URL carefully. Even small differences can indicate a fake website designed to steal login credentials.

Branding inconsistencies

Fraudulent messages may use outdated logos, incorrect colors, or formatting that doesn’t match Wells Fargo’s current branding. If something looks slightly off, compare it to recent communications from Wells Fargo or the official website.

Generic greetings

Scammers often avoid personalization because they send messages in bulk and usually don’t have accurate customer details. Using generic greetings like “Dear customer” lets them reuse the same script without knowing who actually banks with Wells Fargo. Legitimate Wells Fargo messages are more likely to include personalized details rather than vague greetings.

What to do if you receive a suspicious Wells Fargo message

If you suspect a message may be a scam, take the following steps to protect yourself.

- Verify the sender’s contact details: Compare the email address, phone number, or website link with the official contact information listed on Wells Fargo’s website.

- Don’t reply or engage: Avoid responding to the message, clicking links, or downloading attachments until you’ve confirmed it’s legitimate.

- Check your account directly: Sign in securely through the official Wells Fargo app or website and review recent transactions.

- Lock your cards if needed: Use Wells Fargo’s official tools to temporarily freeze your cards if you’re concerned about unauthorized activity.

- Contact Wells Fargo: Reach out using the phone number on the back of your card or the official website, and not the information provided in the message.

- Report the scam: You can report the scam on Wells Fargo’s fraud report page and directly to the Federal Trade Commission (FTC) to help them keep track of active scams.

How to keep your Wells Fargo account safe

You can configure settings from inside your Wells Fargo app or online banking to minimize the risk of unauthorized access and spot suspicious activity early.

- Set up alerts: Turn on account, transaction, and security alerts in the Wells Fargo mobile app so you’re notified as soon as something unusual happens.

- Use biometric sign-in (if available): Enable fingerprint or face recognition in the app for faster, more secure access (if your device supports it).

- Add two-step authentication (2FA): Add an extra verification step so scammers can’t sign in with only your password.

- Monitor your accounts regularly: Review recent transactions and messages inside the app or on the website instead of relying on unexpected alerts.

- Check card controls: Formerly known as Control Tower, Wells Fargo now has card controls. This allows you to see and change which of your cards are active, how your cards can be used outside of the U.S., and review which digital wallets your card is connected to.

- Review authorized devices: Remove old phones or tablets from your Wells Fargo security settings so only devices you trust can sign in.

FAQ: Common questions about Wells Fargo scams

What’s Wells Fargo’s number for scam reporting?

Wells Fargo asks customers to report fraud by using the contact information on its official website or the phone number printed on the back of their card. If you look for confirmation on the Wells Fargo website, make sure you’re on the official one and not a copycat or fraudulent replica.

How do I verify a message from Wells Fargo?

The safest way to verify a message is through the official Wells Fargo mobile app or by typing “wellsfargo.com” into your browser. If the alert is real, you’ll see it inside your account. You can also compare the sender’s details with the contact information listed on Wells Fargo’s official site. If you’re still unsure, call the bank by using the phone number on the back of your card or the official Wells Fargo website.

Is Wells Fargo responsible for scam refunds?

Wells Fargo may refund unauthorized debit or credit card transactions under its Zero Liability protection, but refunds aren’t guaranteed for Wells Fargo scams where you approved the transfer, even if you were tricked.

How can I tell a real text or email from a fake one?

Your bank won’t ask for your PIN, password, or one-time access codes. Fake messages often have certain tell-tale signs, like awkward language, generic greetings, odd formatting, look-alike email domains, or unfamiliar phone numbers. If anything seems off, don’t click the link. Sign in through your bank’s official app or website to confirm whether the alert is genuine.

What’s the latest scam targeting Wells Fargo users?

Wells Fargo warns that imposter scams are a growing trend. Scammers spoof official phone numbers, copy real email domains, and use AI-generated voices to sound like bank staff or even a family member in distress.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN