Identity theft prevention: How to protect your personal and financial information

Identity theft is a rapidly growing problem that can have devastating financial, emotional, and potentially even criminal consequences. In this digital era where our lives are increasingly lived online, protecting your personal information has never been more important.

This comprehensive guide will equip you with the knowledge and actionable steps you need for effective identity theft prevention. It will cover everything you need to know, from recognizing the warning signs to implementing best practices that safeguard your data from criminals.

Please note: This information is for general educational purposes and not financial or legal advice.

What is identity theft, and how does it happen?

Identity theft is when someone steals personal information, like your name, Social Security number (SSN), or financial account details. When this stolen information is used for personal gain, it becomes identity fraud.

This distinction isn’t set in stone, though. For instance, the U.S. Department of Justice considers both “identity theft” and “identity fraud” as terms referring to a crime in which personal information is stolen and misused.

Identity theft can happen in many ways, from old-fashioned methods like stealing wallets to more technological means like phishing emails or spyware. There are various forms of identity theft, including using stolen information to open bank accounts, claim benefits, order goods, take out phone contracts, and more.

Common tactics used by identity thieves

Identity thieves use both digital and physical methods to steal personal data. Here are some common methods:

- Phishing: Scammers use fraudulent emails, text messages, or phone calls that appear to be from a legitimate company to trick you into revealing sensitive information.

- Skimming: This involves placing devices on card readers to steal credit card data when you make a purchase.

- Shoulder surfing: Criminals can simply watch you enter your PIN or password in public spaces to steal your information.

- SIM swapping: Thieves trick your mobile carrier into porting your phone number to a new SIM card they control. This gives them access to your calls and text messages, including two-factor authentication (2FA) codes.

- Malware: Malicious software like keyloggers can be installed on your device without your knowledge to covertly collect and transmit personal data, passwords, and banking details to cybercriminals.

- Data breaches: If a company whose product you use has weak data security and is breached, your personal information may be compromised. This stolen data is often sold on the dark web and used by criminals for identity fraud.

What makes your personal data vulnerable?

Your personal data can become vulnerable through a variety of digital and physical security weaknesses, including the following:

- Poor password habits: Using the same password across multiple accounts or creating easily guessable passwords makes your data susceptible to theft after a single breach.

- Public Wi-Fi: Unless you’re actively protecting yourself on public Wi-Fi with a virtual private network (VPN), these potentially unsecured networks can expose your information to hackers who intercept data transmitted over the network.

- Improper document disposal: Throwing away documents containing sensitive information like bank statements or medical bills gives thieves the chance to steal your data through "dumpster diving," which is when they physically go through your trash hoping to find sensitive documents.

- Oversharing: Posting personal details on social media, such as your birthday, hometown, or family names, can give thieves the information they need to answer security questions to access your accounts.

Who is most at risk of identity theft?

Anyone can become a victim of identity theft, but certain groups are more susceptible. Children, for example, are at a higher risk because their SSNs are often unused and unmonitored for years, making them easy targets for criminals.

Military service members on active duty are also at increased risk. The Federal Trade Commission (FTC) has highlighted that they’re 76% more likely than other adults to report identity theft.

Why identity theft prevention matters

Beyond the immediate financial loss, identity theft may lead to long-term consequences that could disrupt your life and damage your reputation. Proactive identity theft prevention is essential to protect your credit, personal relationships, and peace of mind from the serious fallout of fraud.

Identity theft by the numbers

In 2024, the FTC in the U.S. received over one million reports of identity theft. Additionally, over 118,000 cases of identity theft were reported to the National Fraud Database (NFD) in the U.K. in the first six months of 2025.

With numbers this significant, it’s not surprising that identity theft leads to significant financial consequences. Consumers in the US lost $27.2 billion to identity fraud in 2024, which is 19% higher than the losses reported in 2023. Meanwhile, UK Finance reported that criminals in the UK stole roughly 1.17 billion pounds through identity fraud in 2024.

Emotional and financial consequences for victims

In a 2023 Consumer Impact Report from the Identity Theft Resource Center, around 30% of respondents reported that they had fallen victim to an identity crime in the last year. Of these people, 29% said they had experienced financial losses of $10,000 or more, and over 65% said they were still struggling to resolve the issue months after discovering it.

Alongside the financial toll, identity theft and fraud can lead to significant emotional consequences. After having their identities stolen, victims can have feelings of vulnerability or powerlessness. In severe cases, identity theft can potentially lead to depression and anxiety or even suicidal thoughts.

How to prevent identity theft

Implementing the identity protection tips below in your daily life can significantly reduce your risk of becoming a victim.

Freeze your credit with all three bureaus

A credit freeze can make it harder for thieves to open new accounts in your name. It restricts access to your credit report, meaning a lender cannot extend new credit without your permission. Note that you must place a freeze with each of the three major credit bureaus in the U.S.: Equifax, Experian, and TransUnion.

Use strong passwords and two-factor authentication

Enhancing your online safety with a strong, unique password for every online account is a fundamental defense against digital identity theft. The Cybersecurity and Infrastructure Security Agency (CISA) recommends having unique passwords for each account that are at least 16 characters long, with mixed-case letters, numbers, and symbols.

Using a reliable password manager like ExpressVPN Keys, which is included with the ExpressVPN Advanced and Pro plans, can help you easily generate and store unique, complex passwords for all your accounts.

Another crucial step is enabling two-factor authentication (2FA) wherever possible. This requires a second form of verification, like a code sent to your phone, making it much harder for thieves to access your accounts even if they have your password. ExpressVPN Keys can generate 2FA codes for your compatible accounts.

Monitor your credit and financial accounts regularly

Regularly checking your financial statements and credit reports allows you to catch fraudulent activity early, so ensure you review your credit card and bank statements for any unfamiliar charges or withdrawals. Additionally, in the U.S. you’re entitled to a free credit report once every 12 months, and it’s a great idea to use this to monitor for any suspicious changes.

Avoid phishing scams, spoofing, and suspicious links

Phishing scams can be a way for identity thieves to steal other people’s information, potentially leading to identity fraud. Always be suspicious of unsolicited emails, text messages, or phone calls asking for personal information, even if they appear to be from a trusted source. Also, never click on suspicious links or download attachments from unknown senders. Being careful about this will help you avoid phishing scams.

Protect your physical documents and postal mail

Due to the aforementioned “dumpster diving,” it’s worthwhile to shred any documents that contain personal details, such as bank statements, credit card offers, and medical bills, before you throw them out.

Criminals might even resort to stealing your incoming mail, so you should consider a lockable mailbox to prevent this from happening.

Secure your mobile devices, browsers, and Wi-Fi

You need to ensure your mobile devices, browsers, and Wi-Fi are well secured, as any of these can potentially provide a gateway for cybercriminals to access your information. For browsers, you should enable HTTPS-only mode, as this forces an encrypted connection between your browser and the websites you visit.

It’s also crucial to protect your home Wi-Fi with methods like strong passwords and Wi-Fi Protected Access 3 (WPA3) encryption. If you’re out and about, use a VPN to encrypt your traffic on public Wi-Fi to prevent identity thieves from spying on your traffic and stealing your information.

Enabling remote wipe functionality on your mobile devices is also a good proactive measure. It’s a feature available on Android and iOS devices that lets you remotely wipe all data from your device if it’s ever stolen. It’s also a good idea to configure your phone and app settings to share as little data as possible.

Be careful about what you share on social media

Sharing too much information on social media can make it easy for identity thieves to break into your accounts. Practice privacy protection and avoid revealing information like your full birthdate, phone number, or address, as identity thieves may use these details to answer security questions and gain access to your accounts.

Protect your SSN

Your SSN is a direct link to your financial identity and is a prime target for identity thieves. Never carry your Social Security card in your wallet, and only provide your number when absolutely necessary, such as for a job application, a new financial account, or a medical provider.

The Social Security Administration (SSA) also recommends asking why it’s needed whenever you’re asked to provide your SSN, and checking whether there’s an alternative that can be used.

Use a digital wallet for payments

Digital wallets are widely regarded as a safer alternative to using physical cards. Options like Apple Pay and Google Pay use tokenization, replacing your card number with a unique, one-time code for each transaction. This means the merchant never sees your actual card number, protecting it from being stolen at the point of sale.

Early warning signs that your identity is at risk

With the above information in mind, the following are some of the key early warning signs that indicate your identity is at risk:

- Financial or credit activity: New accounts, unknown charges, or sudden drops in your credit score are the main signs to watch for.

- Notifications or bills: Receiving preapproved credit offers, unrecognized medical bills, or collection calls for debts you’re unaware of are telltale identity theft signs.

- Government notices: Notices for taxes you don’t owe or calls to appear in court for crimes you didn’t commit are serious indicators that your identity has been compromised.

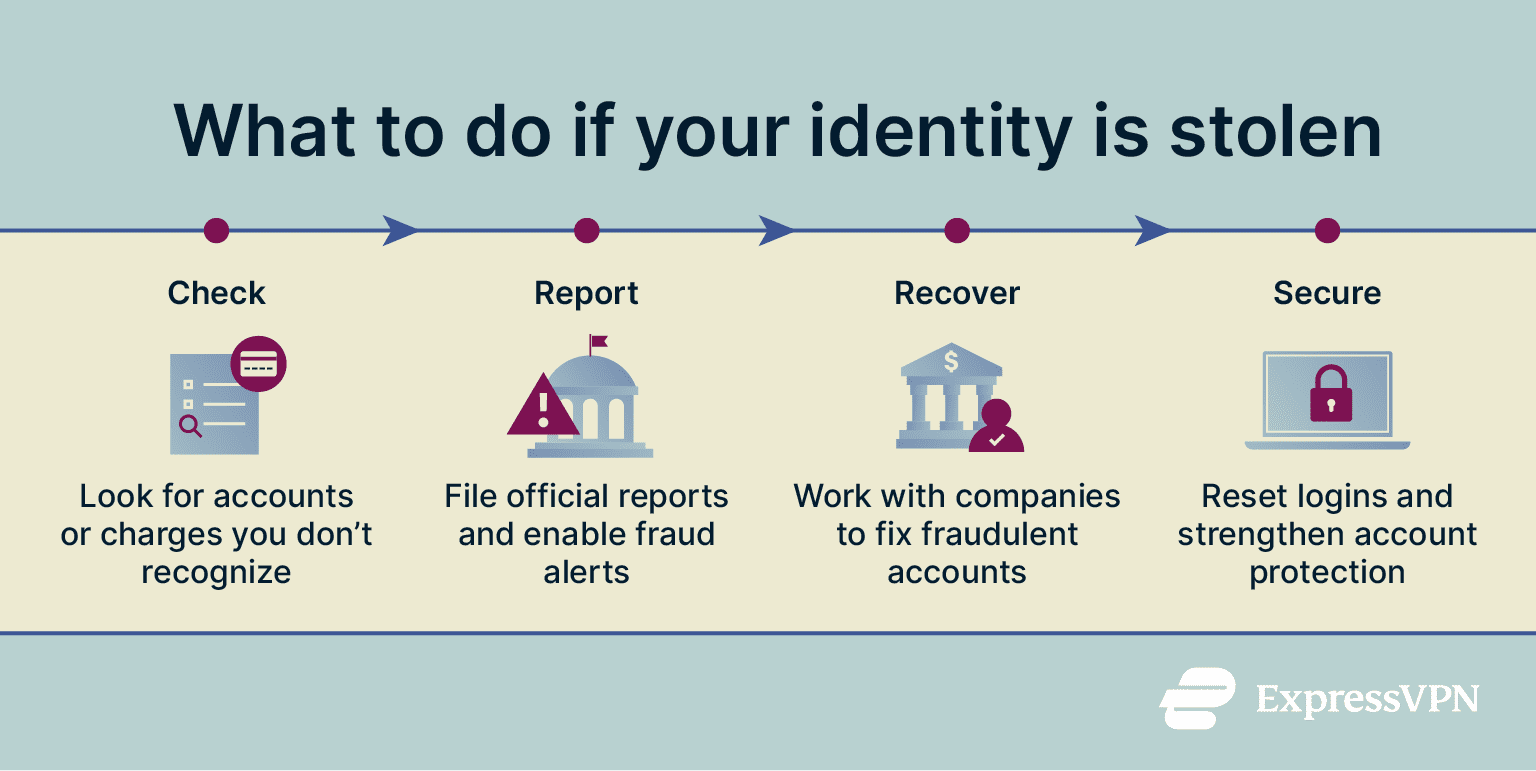

What to do if your identity is stolen

If you suspect identity theft, following the steps below can help you start the process of reclaiming your identity and finances. For more information, see our detailed guide on what to do if your identity is stolen.

Note: The following steps are general guidance. For personalized assistance, consult the FTC, your bank, or a qualified legal/financial professional.

Check if someone is using your identity

The first step is verifying whether your identity has been stolen. Immediately review credit reports from all three credit bureaus and check for any accounts or information you don’t recognize. Additionally, you should go through your bank and any other financial statements to find suspicious or unrecognized transactions.

Report the identity theft to the authorities

Once you’ve verified identity theft, the next step is reporting it to the authorities. In the U.S., you can report it to the FTC online at IdentityTheft.gov or by calling 1-877-438-4338. Afterward, you should call all three credit bureaus and ask them to put a credit freeze and fraud alerts on your accounts. Additionally, you need to inform the fraud department at all credit card issuers and banks where you have accounts.

Depending on the type of identity theft, you might have to inform other authorities as well. For instance, you need to fill out Form 14039 (Identity Theft Affidavit) if you think you’ve been a victim of any tax-related identity fraud.

Recover your credit and online accounts

After reporting to the necessary authorities, you can start the process of recovering your accounts and credit. Contact any companies where fraudulent accounts were opened or where unauthorized charges were made. Inform them of the situation and inquire about recovery steps.

Of course, you should also change passwords for all your online accounts, including banking, social media, tax, and any others. Getting a password manager can make this process much more efficient.

How long does it take to recover from identity theft?

The time it takes to recover from identity theft varies greatly depending on the type and scope of the fraud. Recovering from small-scale credit card fraud might only take a few days, but it could take months or even years to recover from significant financial, medical, or criminal identity theft.

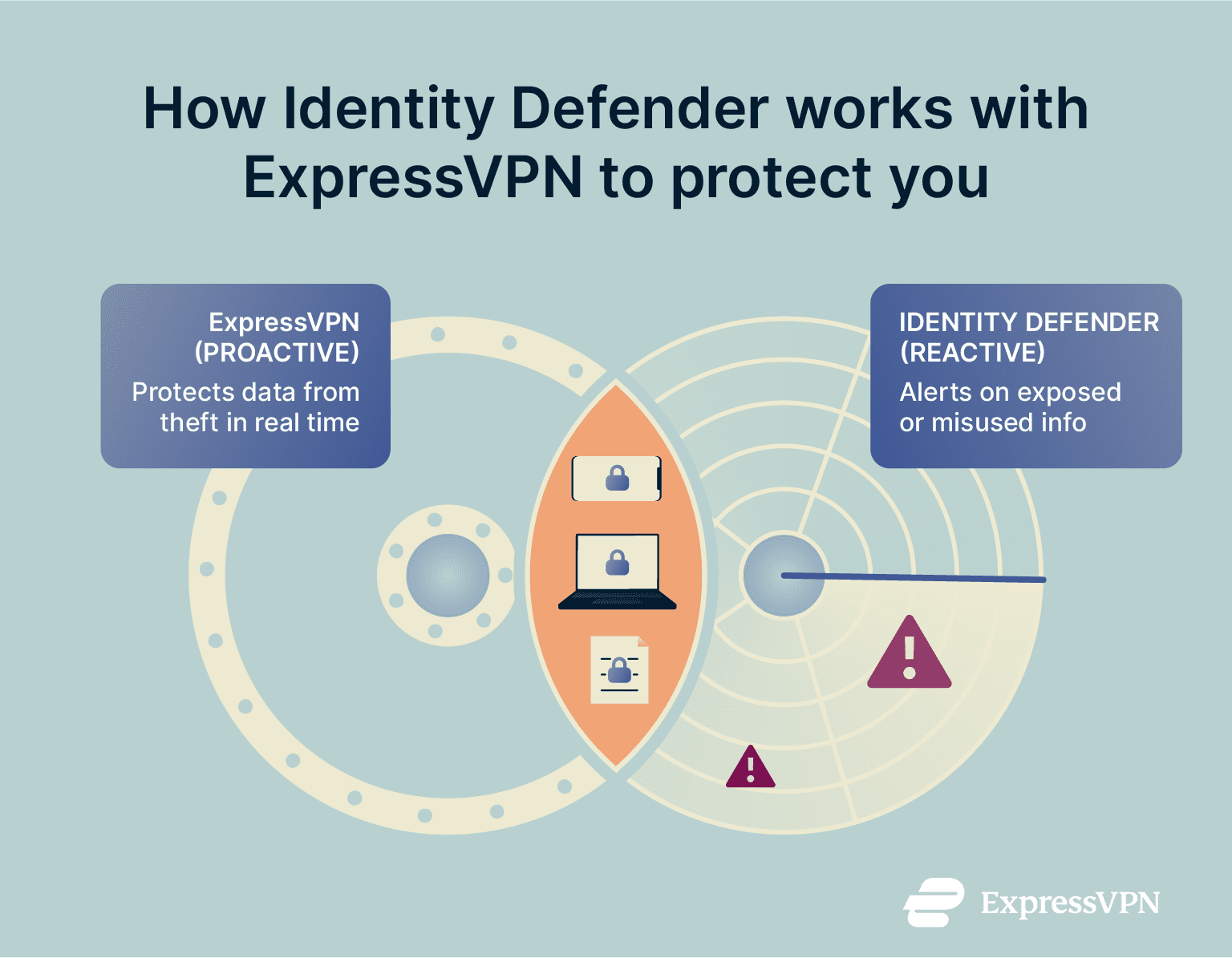

How Identity Defender by ExpressVPN helps protect you

Considering the serious consequences of identity theft, many people choose to use tools that can help them spot and defend against it. ExpressVPN’s Identity Defender, available for U.S. subscribers, offers a set of monitoring features for this purpose.

What Identity Defender monitors

Identity Defender provides ID Alerts for comprehensive monitoring, which checks many records and public information to inform you about activity that concerns your personal information security. Its key monitoring features include:

- Dark web monitoring: Regularly scans the dark web and informs you if your personal information gets leaked onto it.

- SSN monitoring: Provides alerts whenever your SSN is used for loans, employment, or any other activities.

- Address monitoring: Informs you if your address is ever changed with mail redirection.

Thanks to the thorough monitoring, Identity Defender’s ID Alerts ensure you’re constantly kept aware of key information regarding the use of your personal data.

Alongside monitoring for leaked information, Identity Defender provides an in-app credit scanner that you can easily access, a data removal service to scour data broker and people-search websites and remove your details, and even insurance* that may provide reimbursement for certain covered losses, subject to terms and conditions.

ExpressVPN also offers a free tool in the U.S. that tells you which data brokers and people search sites have your data. Simply enter your name, age, city, and state, and you can see what sensitive information is exposed.

How it works with ExpressVPN and other privacy tools

Think of privacy tools like ExpressVPN and Identity Defender as two halves of a comprehensive identity protection strategy. The VPN is the proactive half, encrypting your internet traffic to prevent cybercriminals from stealing your data. Identity Defender is the reactive half, monitoring for data breaches and providing alerts if any information is exposed.

When to use third-party identity theft protection services

Since data breaches are widespread and unpredictable, it is always worthwhile to have a third-party service monitoring for your exposed data. Even if you take great security measures, it’s always possible for a company you do business with to be compromised, exposing your information without your knowledge.

A third-party service like ExpressVPN’s Identity Defender can look out for your personal information security on an ongoing basis, rather than you having to remember to make manual checks.

Best of all, Identity Defender works entirely within the ExpressVPN app, saving you from the configuration and app setups that might be involved with other digital identity theft protection services.

FAQ: Common questions about identity theft prevention

What is the best identity theft prevention?

The best identity theft prevention is a combination of following best practices to protect your personal data, alongside using a reliable tool like ExpressVPN Identity Defender to ensure you’re kept in the loop if your sensitive information is ever compromised.

How do I check if someone is using my identity?

There are several telltale signs that your identity has been compromised, like unrecognized entries in your financial statements, government notices regarding court summons or taxes, and a sudden change in your credit score.

How do I protect my SSN from identity theft?

An effective way to protect your Social Security number (SSN) is by never carrying your Social Security card with you and only giving out the SSN when needed, like for a job application or to a healthcare provider. Additionally, it’s worthwhile asking whether you can provide any alternative information for verification whenever you’re asked for your SSN.

*The insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under group or blanket policies issued to Array US Inc, or its respective affiliates for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN