Internet fraud: Definition, types, prevention, and recovery

Internet fraud keeps growing every year, and the numbers are staggering. Scammers are stealing billions of dollars from people and businesses worldwide, and there’s no sign of it slowing down. The damage isn’t just financial; it can also take an emotional toll and, in some cases, even lead to full-on identity theft.

That’s why we put this article together. We’ll walk you through what internet fraud actually is, the most common scams you might come across, and, most importantly, how you can protect yourself from falling victim to them.

Please note: This information is for general educational purposes and not financial or legal advice.

What is internet fraud?

Internet fraud is an umbrella term for a large list of crimes committed over the internet where a criminal deceives someone to obtain their money or personal information. Examples of these online scams include identity theft, phishing scams, fake online lotteries, and ransomware. They affect both individuals and organizations alike and can cause crippling financial problems.

Unlike offline fraud, criminals can take advantage of the internet's anonymity. Scammers often hide behind spoofed email addresses or fake websites to trick victims without giving away their identity. Because many internet fraud rings exist across multiple country borders, investigations are complex and require collaboration among international law enforcement agencies.

Common forms of internet fraud

Scammers use all kinds of tricks, and their methods can look very different from one group to another. But at the core, every type of internet fraud comes down to the same thing: someone hiding who they really are to steal your personal information or money.

Phishing scams

Phishing is a type of social-engineering scam where fraudsters send emails, texts, or social media messages that look like they’re from a company, a family member, or an organization you trust. They’ll usually ask you to click a link, open an attachment, or share personal details.

Most phishing attempts start with a made-up story. Scammers might claim there’s a problem with your account, send a fake invoice, dangle a coupon, or say you’re owed a refund. The goal is simple: get you to react. Even if you don’t hand over information, just replying can tip them off that your account is active.

For businesses, phishing can be especially damaging. It’s not unusual for scammers to pretend to be high-level executives, like the CEO, and pressure employees into handing over sensitive data or downloading malicious files.

Malware and ransomware attacks

Malware is any malicious software, including viruses, spyware, or ransomware, that gets installed on your device without your consent. Fraudsters may use it to infect your device and steal personal information, display unwanted ads, or gain unauthorized access to your system.

If you accidentally installed malware on your device, a criminal could use that malware to create a backdoor on your device, weaken your security settings, or directly extract data.

Ransomware is a form of malware that involves a criminal gaining access to your data, stealing and encrypting it, and then demanding money to unlock those files. Once you pay, the scammers may further extort you, rather than give you back the data.

Online shopping and auction scams

Another tactic used by scammers is to create fake online shops or hijack legitimate websites to steal customers' money and payment information. Cybercriminals can build sites that imitate well‑known retailers and offer dramatic discounts to lure shoppers into providing their card details. The order is never fulfilled, but the victim's money and details are taken.

Other common tricks for buyers include formjacking (when malicious code is secretly added to checkout pages) and auction fraud (fake or misleading listings that get you to pay for items that don’t exist or aren’t what was promised). Sellers, on the other hand, can face overpayment schemes, where a scammer sends more money than the agreed price and then asks for a refund of the “extra.” Once their original payment bounces, the seller is left out of pocket.

Investment and cryptocurrency scams

Investment scams promise high returns with little risk but ultimately run away with a victim’s money. These types of scams rely on cryptocurrency, rare metals, and other seemingly great investments that have historically done well. This gives the illusion that the scam will be successful.

In this scam, fraudsters pose as investment managers, celebrities, or even potential romantic partners. After establishing trust, they instruct victims to buy crypto and transfer it to them or to invest in a specific investment “opportunity.” They may also impersonate government or job recruiters and demand fees.

Romance and dating scams

Romance scams involve criminals creating fake profiles on dating sites or social media to build emotional connections with victims. Once trust is established, the scammer claims to need money for emergencies, like medical bills, travel, or rent, and requests funds.

The victim is typically invested in their relationship and is more willing to send money than if the request came from a stranger.

During a romance scam, the fraudster will invent a reason why they can’t meet the victim in person, such as working on an oil rig or needing to travel a lot for work. They may push for quick intimacy and may emotionally blackmail the victim until they pay.

Identity theft and account takeover

Identity theft occurs when criminals obtain and misuse another person’s personal information, such as Social Security numbers (SSNs) or credit card details, to commit fraud. This often includes taking out loans using the victims' data, credit card fraud, or faking their identity to buy expensive items.

Account takeover is a form of identity fraud where criminals use stolen credentials to gain control of existing accounts. Once inside, they can make unauthorized purchases, transfer funds, or sell the account to a third party.

Tech support scams

Tech support scams begin with unsolicited phone calls, pop‑ups, or ad listings pushing you to pay for tech support services that you don’t need. The fraudster may request specific personal information, remote access to your device, or for you to pay a fee to have the service in question restored.

They often request remote access or payments via wire transfer, gift cards, or cryptocurrency, and steal personal data at the same time. Call‑center fraud targeting was responsible for $1.9 billion in losses in 2024 alone.

Job and employment scams

Job scams take advantage of people looking for remote work or new opportunities. Scammers often reach out by email or text, usually from a personal account, and offer what looks like a real job. They’ll send official-looking forms and ask for sensitive details like your SSN or bank account info for “direct deposit.” A real employer will never ask for this kind of information before you’re officially hired.

Some red flags to watch out for include salaries that seem too good to be true, requests for up-front fees, conversations that only happen through social media, or just that gut feeling that something’s “off” about the whole process.

Lottery, prize, and advance fee fraud

Sweepstakes, lottery, and prize scams promise massive winnings but require victims to pay fees or provide personal information to access them. Once the details or money are given, the victim never gets their prize. The scammer tells the victim the fee is for taxes, shipping, processing fees, or something similar.

This type of scam takes advantage of the fear of missing out (FOMO) to trick victims into paying the fee without thinking about it. These often work because the scammer uses something to impress urgency, like a fake timer.

Business and industry-specific fraud

Individuals aren’t the only ones affected by online fraud; every industry faces its own challenges with scams and fraudulent activity. Some threat actors will focus on sabotaging specific critical industries, like the healthcare industry, while others will pursue businesses that depend on their day-to-day operations to survive.

Financial services fraud

The financial sector remains one of the most attractive targets for cybercriminals, and the methods keep evolving. In 2024, check fraud still accounted for more than half of reported cases. However, many criminals have turned to using wire fraud as a means of quickly and easily transferring funds.

Business email compromise scams are the most common type of financial service fraud. In this scheme, attackers impersonate executives, vendors, or trusted partners to trick employees into authorizing payments or revealing sensitive account details.

Retail and e-commerce fraud

For online retailers, fraud isn’t just about stolen cards or spoofed websites; it’s about protecting their entire business model. Scammers might abuse return policies with fake refunds, use stolen loyalty points, hijack customer accounts, or run chargeback schemes that leave merchants on the hook for both the product and the money.

As mentioned above, fraudsters also set up fake storefronts to trick shoppers, which damages the reputation of legitimate businesses in the process.

Healthcare-related scams

Healthcare fraud can happen when providers or patients deliberately deceive insurance programs to pocket illegal benefits. This type of fraud costs tens of billions of dollars each year. Beyond the financial toll, it can raise insurance premiums, lead to unnecessary medical procedures, and even drive up taxes that fund healthcare services.

On the provider side, common tricks include double-billing (charging multiple times for the same service), phantom billing (charging for services never performed), unbundling (splitting one service into multiple claims), and upcoding (charging for a more expensive procedure than the one actually done).

Patients and outside fraudsters also play a role. Some scams involve fake marketing ploys that trick people into handing over their insurance ID, while others use identity swapping or even impersonate healthcare professionals to steal sensitive medical or financial data.

Internet fraud statistics, trends, and emerging threats

Internet fraud is a global concern, and its scope has only broadened over time. According to the FBI Internet Crime Report, the Internet Crime Complaint Center (IC3) received 859,532 complaints in 2024, with reported losses exceeding $16 billion. Phishing and spoofing, extortion, and personal data breaches were the top categories.

Investment fraud accounted for more than $6.5 billion in losses, and victims over 60 lost nearly $5 billion. This is primarily from cryptocurrency scams.

According to the Global Anti-Scam Alliance (GASA), scams cost people around the world more than $1 trillion in 2024. Developing countries are hit the hardest. For example, in Pakistan, scam losses are estimated to equal over 4% of the country’s entire GDP.

AI-driven scams are rising fast worldwide. In 2025 alone, AI impersonation scams surged by 148%. Criminals are increasingly using voice cloning and deepfake video to mimic trusted people, from family members to company executives, making it harder than ever to tell what’s real and what’s fake.

This is largely because large language models (LLM) have significantly lowered the barrier of entry for complex crimes. With very little experience, a criminal can use AI to mass-produce content, fraudulent emails, or deepfake personas designed to trick someone into giving them money.

How to spot internet fraud

Spotting fraud early on is the best way to mitigate any damage it might cause. Look for red flags, including:

- Unsolicited emails or messages: Scammers will create messages with a false sense of urgency or fear. They might claim there’s a problem with your account, tell you that you’re eligible for a refund or a government grant, or offer a coupon. In every case, they’re trying to entice you into responding without thinking first.

- Requests for personal or financial information: Fraudsters will use fake websites, forms, or emails to trick you into giving up sensitive details, like your SSN, bank account information, or passwords. Legitimate organizations will rarely ask for this information over email or text. You should check the URL of any website you visit to ensure it matches the official website's URL before giving up any personal info.

- Offers that seem too good to be true: Scammers will often pitch things that are too good to be true, like massive lottery winnings, sweepstakes gifts, high-paying jobs, or guaranteed investments. Offers for free products or surprise “winnings” that you never signed up for are almost always scams.

- Poor grammar or spelling: Many scams still give themselves away with typos, clunky wording, or generic greetings. You might also notice signs of AI, like odd phrasing or paragraphs that don’t quite make sense.

- Attachments or links from unknown senders: Be cautious of unexpected files or links, especially if the sender’s name or address looks slightly off. Hover over links before clicking to check the URL. If the URL doesn’t match the text, contains strange characters, or uses misspellings of well-known domains, it’s likely malicious. Attachments with strange file types like .exe or .scr strongly indicate a scam.

Learn more: Read about various types of scams, such as pig butchering scams and Nigerian prince scams, so you’ll know better what to watch for.

How to prevent internet fraud

Preventing internet fraud requires a combination of vigilance and proper cybersecurity tools. Because there are multiple types of dangerous internet fraud, with varied attack vectors, you need a comprehensive plan to protect yourself before it happens.

Protect your personal and financial information

Never give away your personal information to someone whose identity you haven’t personally vetted. If sharing your data is mandatory, use secure channels, such as an encrypted email account.

Don’t post sensitive information on social media or public forums. If someone reaches out to you, don’t tell them personal information; even if you think you know them, confirm it’s really them before responding. Avoid clicking on unsolicited links or attachments.

Finally, don’t give any information or money to a stranger on social media who claims to be a celebrity or that they’re going through an emergency. Remember that no amount of fraud prevention tips can help if you willingly give someone your personal information.

Learn more: Read our detailed guide on how to prevent phishing attacks.

Use strong authentication and encryption tools

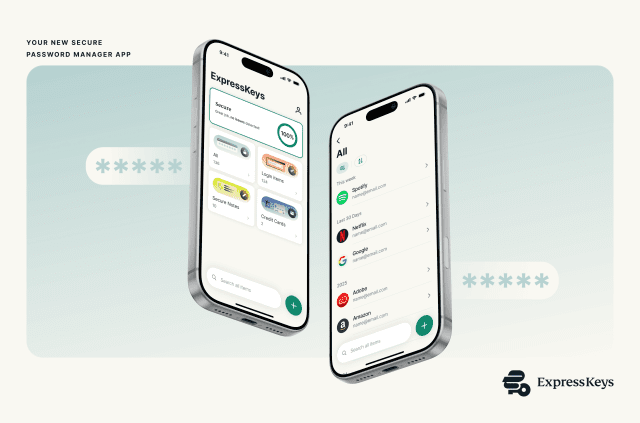

Use unique, complex passwords for each account and store them in a reputable password manager. For optimal password strength, use 14–16 characters and a combination of uppercase and lowercase letters, numbers, and symbols.

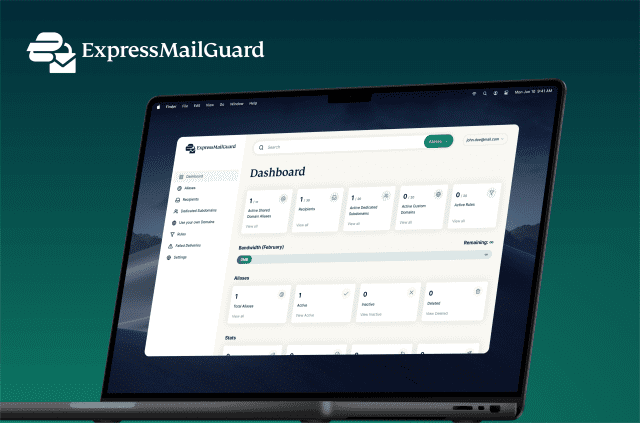

Enable multi‑factor authentication (MFA) for each app that supports it; this uses two or more credentials to verify your identity. Consider using a reliable password manager like ExpressVPN Keys that stores passwords and allows you to generate one-time two-factor authentication (2FA) codes.

Connect to a virtual private network (VPN) whenever you’re using public Wi-Fi to encrypt your data and mask your IP address. ExpressVPN encrypts your traffic and uses built-in anti-tracking and anti-malware tools to protect you from a wide range of online threats.

Monitor accounts and devices regularly

It's common for a scammer to lie in wait for long periods of time before attempting to use your information. Even if you haven’t recently had a data breach, it’s smart to regularly review your bank statements, credit reports, and online accounts. If there’s a problem, you want to know immediately and be ready to act.

Because it can be risky, difficult, and time-intensive to monitor all of this yourself, consider identity monitoring software. ExpressVPN’s Identity Defender monitors all of your personal information and sends you alerts of any suspicious changes or unauthorized activity. It also scans data brokers for your info and helps remove it before it can be abused by criminals. It’s currently available to U.S. users.

Keep software and security tools updated

Updates for software and devices often fix known vulnerabilities that fraudsters can use to gain unauthorized access to your device, spy on you, or collect your data. Install updates and patches for your devices and applications as soon as they’re available, and enable automatic software updates where applicable.

Learn more: Read our detailed guide about identity theft prevention.

What to do if you become a victim of internet fraud

If you’ve fallen victim to internet fraud, don’t panic. Take a breath, and then follow these steps to limit the damage and reduce the risk of being targeted again.

Note: These are general steps for educational purposes only. The exact steps you should take depend on your situation.

Secure your online accounts

If you’ve been hit by internet fraud, your first move should be to lock down your accounts. Start by changing the passwords on any that were compromised, along with any others that share the same or similar credentials.

Turn on MFA wherever it’s available, as it adds an extra layer of protection that scammers can’t easily bypass. After that, run a full scan with your device’s security or antimalware software to check for anything suspicious. This helps clear out any malware that might have caused (or been planted during) the attack.

Report the incident to authorities

Report fraud to the appropriate authorities, such as the FBI’s Internet Crime Complaint Center (IC3) for cybercrime or the Federal Trade Commission (FTC). Provide all communication, receipts, and documentation. Reporting helps officials identify patterns and warn others.

If you’re outside the U.S., you should report the crime to your country’s consumer protection agency, cybercrime reporting portal, or local law enforcement.

Monitor credit and identity data

After contacting the authorities and locking down your accounts, keep a close eye on your financial and identity records. Start by notifying your bank or financial institution and placing fraud alerts on your credit files. In cases of wire fraud, your bank or transfer company may be able to help reverse the charges, but if cryptocurrency was involved, recovery is usually much harder.

You may also consider freezing your credit with one of the three major credit bureaus to stop new accounts from being opened in your name. ExpressVPN’s Credit Scanner helps you stay on top of your financial health by tracking your Experian credit score and monitoring changes that could signal fraud. Available to ExpressVPN users in the U.S., it provides regular updates, detailed reports on accounts and balances, and alerts about suspicious activity.

For even deeper protection, ID Alerts monitors your identity data in real time. It scans the dark web for your personal information, checks for unauthorized address changes, and tracks misuse of your SSN. If something suspicious turns up, like your details for sale on hidden forums, you’ll be notified right away so you can take action before the damage spreads.

Seek professional support if needed

If your losses are significant or if criminals gained access to sensitive financial or medical records, you should seek out legal help. A lawyer or financial advisor can help with any obligations you have to law enforcement and may help you get reimbursed, when applicable.

FAQ: Common questions about internet fraud

Can internet fraud be prosecuted internationally?

Yes, but it’s complicated. In cyber fraud, a single attack might have threat actors, servers, and victims in multiple jurisdictions at once. It’s harder to prosecute and requires international treaties and the cooperation of international law enforcement agencies. Always report online scams that you encounter.

How can VPNs help protect against fraud?

A virtual private network (VPN) creates an encrypted tunnel around your data that protects it as it travels through the internet. VPNs hide your IP address and make it harder for attackers to identify you or intercept your data.

ExpressVPN also includes protection against trackers, a built-in ad blocker, and protection against online threats, making it a well-rounded security service that protects you against most forms of internet fraud.

Are some demographics more at risk of internet fraud?

Older adults often suffer higher financial losses, even if younger people report scams more frequently. Data from the Federal Trade Commision (FTC) shows that people aged 20–29 were more frequently the victims of scams, but the elderly lost significantly more to each scam.

According to the FBI Elder Fraud report, Americans over 60 lost about $3.4 billion to fraud in 2023, and the average amount they lost exceeded $33,000. Young adults are more prone to social‑media investment scams, while older adults are often targeted by impostor, tech‑support, and romance scams.

What types of internet frauds are most common?

Phishing scams, extortion, and personal data breaches are currently the most common types of internet fraud. In 2024, the FBI reported losses over $16 billion due to scams.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN