Confidence tricks explained: How they work and how to avoid scams

Most people will encounter a scam at some point in their lives. An email claiming your account has been compromised asks you to reset your password. A caller claiming to be a bank representative urges you to confirm your account information. These are both examples of a common type of scam called a confidence trick, a scheme designed to steal your hard-earned money, property, or personal information.

In this article, we explain how confidence tricks work, examine popular types, and show you how to spot them. We also cover what to do if you’ve fallen victim to one.

What is a confidence trick?

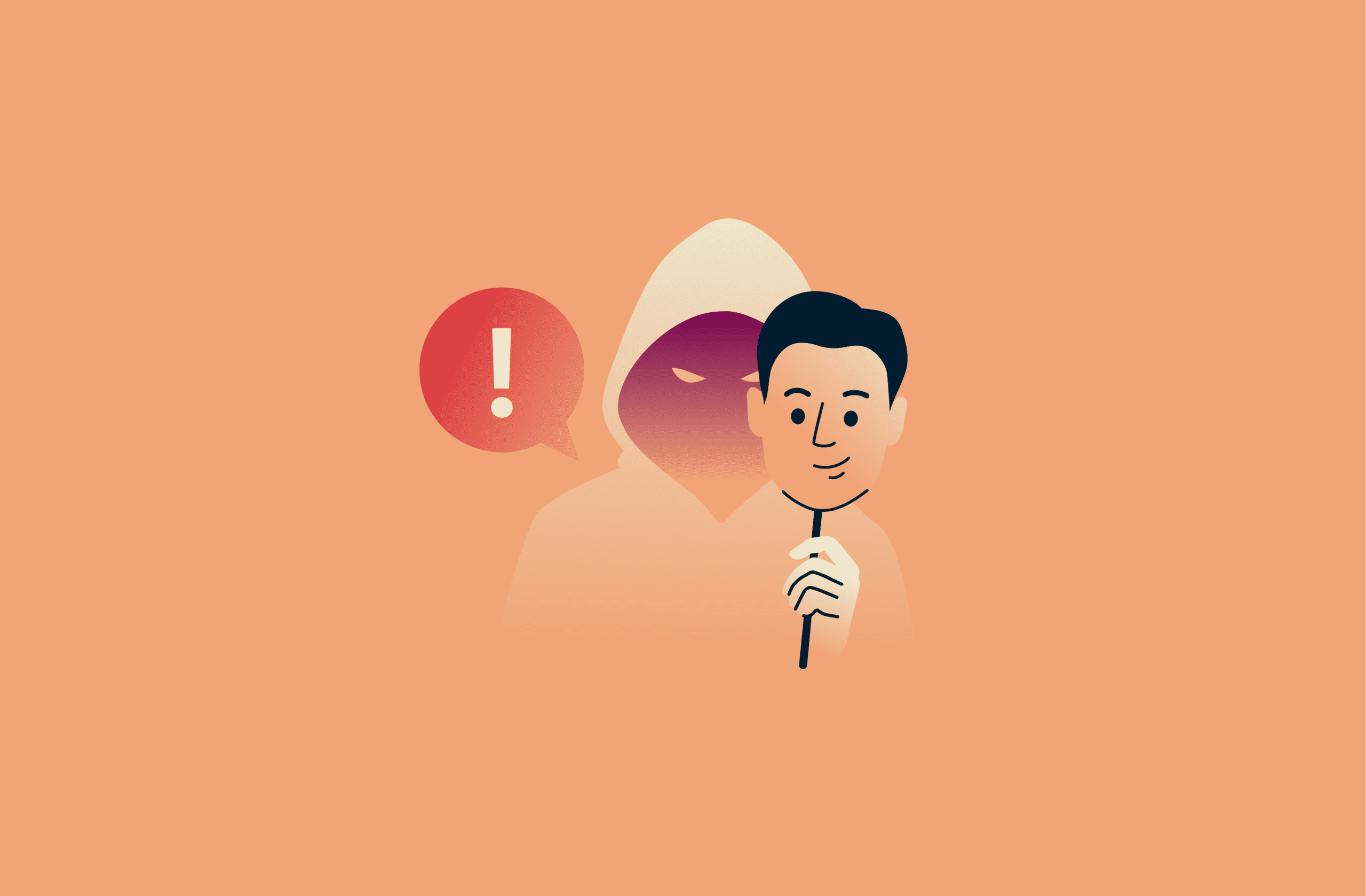

A confidence trick is a type of scam that involves gaining a victim's trust (i.e., their “confidence”) and then exploiting that trust for personal gain.

“Confidence trick” is often abbreviated as “con” and is associated with terms like “con artist.” It’s synonymous with “confidence game” and “confidence scam.”

How confidence tricks work

Confidence tricks are a type of trust-based scam that use social engineering and psychological manipulation to persuade victims to act against their own best interests.

The psychology behind confidence tricks

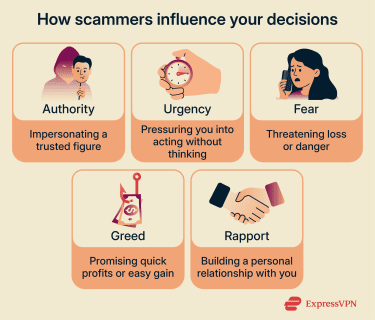

There are several psychological levers used by scammers to manipulate victims, including authority, urgency, and fear. Understanding these tactics can help you recognize and resist confidence tricks.

Here are some of the most common psychological manipulation techniques:

- Authority: The scammer pretends to be a trusted figure, such as a bank or customer support representative, to make their requests seem legitimate. People are naturally inclined to obey authority figures, which scammers exploit.

- Urgency: Victims are pressured into making a decision quickly without thinking things through. Scammers accomplish this by presenting a limited-time opportunity or claiming that immediate action is required to avoid a negative consequence.

- Fear: Threats of negative outcomes, like account closure, legal trouble, or financial loss, may override the victim’s caution. This is often used alongside the strategy of creating a sense of urgency.

- Greed: Scammers play on the desire for financial gain or exclusive rewards. They promise prizes, investment opportunities, or rare deals designed to tempt victims into handing over money or personal information.

- Rapport: Unlike quick-hit scams, some confidence tricks involve building a relationship over time. Scammers use charm, flattery, and shared interests to create a false sense of friendship or romance. They might mirror your body language, share personal stories, or mimic your communication style to build trust and lower your defenses.

The role of technology in modern confidence scams

Technology has made confidence scams a bigger threat than ever. Key ways scammers exploit digital tools include:

- Mass reach: Email, messaging apps, social media, and other digital platforms allow scammers to contact many potential victims quickly. Scammers can also reach people across the globe, regardless of where they are based.

- Anonymity: It can be difficult to verify identities online, so scammers can easily disguise themselves as legitimate organizations or even friends and family. This can also make it harder for law enforcement to trace their activities.

- Automation: Scammers can use AI and bots to create and send large volumes of messages quickly, allowing them to reach many potential victims efficiently. For example, bots can distribute thousands of phishing emails or post scam links on hundreds of different Discord channels.

- Personalization: AI technology can help scammers craft highly personalized messages and simulate human interactions, making scams more convincing. For example, AI has been used for voice cloning scams and deepfake videos to trick victims out of their money.

Types of confidence tricks

Confidence tricks appear in many forms. Below are some of the most well-known fraud schemes and real-life cases where they happened.

Romance scams

In romance scams, the fraudster builds an intimate relationship with the victim, then abuses the victim’s affection and trust for personal gain. This often involves requests for money for fabricated needs or emergencies. Scammers may also request sensitive personal information or manipulate victims into performing illegal or risky actions.

Fraudsters using this type of confidence trick usually operate online over dating apps or social media platforms. These channels make it easy to create false identities and initiate contact with strangers. It’s also common for scammers to avoid meeting the victim in person, as doing so increases the risk of getting caught. In military romance scams, the fraudster poses as a deployed service member to explain why a meeting isn’t possible.

One real-world example of a romance scam involved a woman in the UK who was scammed out of over £100,000 by someone she met online. The scammer convinced her that he loved her and then persuaded her to send money for various reasons, including family crises and medical bills. In the end, she was only able to break free from the scam with the help of her sons, and only after losing all of her savings and taking out loans to cover his requests.

Grandparent and family emergency scams

In grandparent and family emergency scams, the fraudster convinces the victim that a loved one is in trouble. They then request money to resolve the fabricated situation. For example, the fraudster may pose as a police officer, doctor, or lawyer and convince the victim that their child has been in a car accident or been arrested. They may also pose as the loved one directly.

This type of scam is called a grandparent scam because fraudsters often target older adults, who may be less familiar with modern scam tactics.

A large-scale example involved a group of Canadian fraudsters who targeted U.S. retirees, ultimately stealing an estimated $21 million. The scammers called grandparents, claiming that their grandchild had been in a car accident and arrested. They then urged the victims to send money for bail.

Fake investment and get-rich-quick schemes

In fake investment and get-rich-quick schemes, fraudsters encourage victims to invest in opportunities, typically promising high returns in a short period of time. The money, however, goes directly to the scammer instead.

These scams often leverage a sense of urgency. For example, the fraudster may claim that the opportunity is only available for a limited time. They may also use fake websites, doctored documents, or testimonials to make the opportunity appear more credible.

A real-world example of this type of scam involved the use of AI to create a Facebook advert. The ad featured deepfakes of Martin Lewis, a well-known UK financial expert, and Elon Musk, promoting a fraudulent crypto investment scheme. Victims who “invested” ended up losing their money to the scammers.

Phishing scams

In phishing scams, fraudsters attempt to trick victims into revealing sensitive information, such as login credentials, credit card numbers, or account details. This is typically done by impersonating a legitimate organization.

For example, the fraudster may send an email where they pose as a bank, government agency, or popular online service. The message may include a link to a website that looks legitimate but is actually controlled by the scammer. When the victim enters their information, the scammer can capture and use it to access accounts, steal funds, or commit further fraud. This is a common scam on online marketplaces like OfferUp.

A recent example of a phishing scam involved scammers posing as the U.S. Postal Service (USPS). The fraudsters sent text messages claiming a package couldn’t be delivered until the recipient confirmed their information and included a link to a fake USPS designed to steal personal data.

Related: What is clone phishing?

Warning signs of a confidence trick

To avoid falling victim to a confidence trick, it’s important to learn how to recognize popular deception tactics. Be wary of:

- Unrealistic promises: Be skeptical of anything that seems too good to be true, like investments promising fast profits and guaranteed returns, or claims that you’ve won a giveaway you never entered.

- Artificial urgency: Stop and think if you’re ever pressured to act immediately or told you must act before a deadline to avoid consequences.

- Unusual payment methods: If you’re asked to pay for something via wire transfer, cryptocurrency, gift cards, or prepaid vouchers, this is a major red flag. Scammers favor these payment methods because they make it hard for victims to get their money back.

- Requests for secrecy: Scammers sometimes make up reasons to discourage you from checking facts or seeking advice. For example, a scammer running a grandparent scam might ask for bail money while claiming that there’s a judge-imposed gag order on the case.

- Requests for sensitive information: To protect yourself from identity theft and other scams, be cautious of anyone who asks for passwords, financial details, or other sensitive information. Legitimate organizations will never ask for this information via email, text, or social media.

- Forced intimacy: As part of a romance scam, a fraudster may call you their soulmate or share personal stories about hardship or loss to gain sympathy. These are scam techniques called “love bombing” and “trauma bombing” used to create a false sense of closeness.

- Suspicious presentation: If you sense something off in a message or on a website, like a misspelled domain (e.g., “paypa1.com” instead of “paypal.com”), a slightly altered or blurry logo, or an overly informal tone, it might be a phishing scam. Learn more in our guide to phishing red flags.

How to protect yourself from confidence tricks

Besides learning how to identify confidence tricks, practicing these safe habits can help reduce your risk:

- Ignore unknown calls or messages: Don’t answer calls from numbers you don’t recognize or respond to unsolicited messages.

- Verify before you act: If you receive a suspicious call, text, or email, contact the person or organization directly through a separate, official channel to confirm whether it’s legitimate.

- Avoid suspicious links or attachments: Never click on links or open attachments from unverified sources.

- Avoid oversharing: Be cautious about what you post on social media or other public platforms; scammers can use this information to craft personalized messages and manipulate you. Consider using a data removal service, like the one included with ExpressVPN’s Identity Defender, to limit what personal information is publicly accessible.

What to do if you’ve been scammed

Even careful people can fall victim to confidence tricks. If it happens to you, knowing what to do can help limit damage.

Secure your accounts and personal information

If there’s any possibility that the scammer has stolen sensitive information

- Change your passwords for any accounts that might have been compromised.

- Enable two-factor authentication (2FA) on your accounts so the fraudster can’t log in without both your password and a second piece of information, like a code from your phone or an app.

- Monitor your bank, credit card, and online accounts for unusual activity.

- Consider placing a fraud alert or credit freeze if financial details were exposed.

Warn others and prevent further damage

If a scam involves someone pretending to be a friend, family member, or colleague, warn your other contacts so they don’t fall for it. Similarly, if your account was potentially compromised, tell your contacts not to trust messages that appear to come from you until your account is secure.

Report the scam to authorities

Reporting the incident helps law enforcement track and stop scammers. Provide as much information as you can about what happened, the scammer’s contact details, any conversation records, transaction details, etc.

In the U.S., you can file a report with the Federal Trade Commission (FTC) or contact the FBI’s Internet Crime Complaint Center (IC3).

FAQ: Common questions about confidence tricks

What is another word for a confidence trick?

“Confidence trick” is often abbreviated as “con.” It may also be referred to as a “confidence game,” “confidence scam,” or simply “scam.”

What is an example of a confidence trick?

An example of a confidence trick is receiving a call from someone claiming to be from your bank, who warns you that your account has been compromised. The caller may sound professional and even know some basic details about you.

They’ll often urge you to “verify” your account by providing them with a one-time code. If you comply, the scammer may use that information to access your account and steal your money.

How can I tell if someone is running a confidence scam?

You can spot a confidence scam by looking for warning signs such as unrealistic promises, unusual payment methods, or requests for secrecy and sensitive information. Scammers may also pressure the victim to act quickly or use flattery and sentimental stories to manipulate them.

Where should I report a confidence trick scam?

If you or someone you know has been scammed, you should report it to local authorities, consumer protection agencies, or specialized organizations. For U.S. residents, you can file a report with the Federal Trade Commission (FTC) and the FBI’s Internet Crime Complaint Center (IC3).

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN