How to spot and avoid a Publishers Clearing House scam

Publishers Clearing House (PCH) scams have become a common way for fraudsters to target unsuspecting individuals. These scams often impersonate the well-known sweepstakes company to trick people into providing personal information or money.

Understanding how to recognize the signs of a PCH scam and knowing how to protect yourself can help you avoid falling victim to these fraudulent schemes. This article will guide you through the key warning signs and practical steps to stay safe.

What is a Publishers Clearing House scam?

A PCH scam is a type of fraud where scammers impersonate the legitimate PCH company to deceive people into believing they have won a prize. These scams often use official-looking logos and messaging to appear authentic. The convincing use of PCH’s well-known brand and prize history makes it difficult for recipients to recognize the communication as fraudulent.

Is Publishers Clearing House a real company?

PCH is a U.S.-based company that began in 1953 as a direct-mail magazine subscription business. Over time, it became famous for huge sweepstakes, contests of chance where people can win prizes without buying anything.

Today, PCH operates primarily as a sweepstakes and digital advertising company. It funds its prizes primarily through revenue generated from the sale of merchandise and magazine offers, along with advertising on its various online properties, while continuing to run free sweepstakes as a promotional tool. Anyone can enter PCH sweepstakes for free, and an entry is required to be eligible to win.

The company’s high visibility and long-standing reputation have also made the PCH name a frequent target for impostors and scammers.

Note: As of 2025, PCH underwent bankruptcy and restructuring under new ownership. These financial changes do not affect how legitimate PCH prize notifications work or how scammers impersonate the brand.

How do Publishers Clearing House scams work?

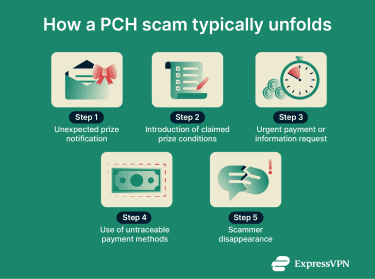

PCH scams usually follow a predictable pattern. They rely on surprise, false authority, and pressure to push victims into sharing sensitive information before they can verify the claim.

- Unexpected contact: The scam usually starts with an unsolicited phone call, text message, email, letter, or social media message. They claim that the consumer has won a PCH prize (often a large cash amount), even if no entry was made.

- Conditional prize release: After announcing the supposed win, scammers explain that certain fees must be paid before releasing the prize. These may be described as processing fees, delivery charges, insurance payments, or taxes.

- Insistence on untraceable payment methods: Scammers typically demand payment via methods such as Western Union, MoneyGram, gift cards, or reloadable cards. These payment types are difficult to trace and nearly impossible to reverse.

- Personal data collection: Sometimes scammers skip immediate payment requests and instead ask for personal or financial information under the guise of verifying eligibility. This data can then be exploited for identity theft or account takeovers, or sold to other fraudsters.

- Pressure and false authority: To prevent consumers from questioning the claim, scammers create a sense of urgency or secrecy. They may impersonate government agencies or use fake names and titles. However, no legitimate government or company will call and demand money to collect a prize.

Common tactics used by Publishers Clearing House scammers

Fake checks sent by mail

Scammers may send an official-looking prize packet containing a fake check and instructions to deposit it. After the deposit, consumers are told to send back part of the money for bogus fees. Eventually, the bank will discover the check is fraudulent, and any money sent will be lost.

Learn more: Read our guide on phishing red flags in emails and what to do about them.

Phone calls demanding payment

Another common approach is a phone call claiming you won a sweepstakes prize, followed by a demand for payment to receive it. A phone-based prize scam can also use a recorded prompt that tells people to call a number and press 1 to learn more. Once they engage, the story escalates into a demand for a fee before they can get the prize.

Impersonation via social media

Scammers often use social media platforms to send messages claiming the consumer has won a prize. Their goal is to trick consumers into clicking a link, which can be used to install malware on your device. They also use brand-like names to seem legitimate. In some cases, scammers tell victims to download apps that impersonate real brands, which can harvest credentials.

Fake “claims agents”

Imposters sometimes pretend to be official claims agents from PCH and provide consumers with phone numbers that route back to the scammers themselves. This tactic makes the scam appear legitimate and prevents consumers from reaching out to the real PCH customer service for verification or assistance.

PCH only asks for basic personal information like the date of birth, name, address, and email to verify eligibility and notify winners.

Phony websites

Scammers create fake websites that closely mimic the official PCH site, aiming to steal personal information or install malware on visitors’ devices. These fraudulent sites may be promoted through unsolicited emails, texts, or social media messages that urge consumers to click on links or scan QR codes to claim their prize.

Any unexpected request to click a link or scan a code to collect a prize should be treated as a red flag for potential fraud.

Learn more: Find out how online address changes became the latest dark web threat.

How to identify a scam notification

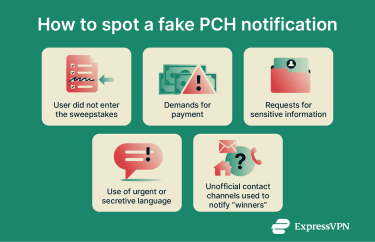

The safest way to verify a PCH prize claim is not to respond, click links, or call back the contact number provided. If a notification arrives by phone, consumers should hang up and contact PCH independently using their official customer service number: 1-800-459-4724. For messages by mail or email, do not follow instructions in the message.

Red flags include:

- Requests for any payment or fees to claim a prize.

- Demands to contact someone to unlock the prize.

- Contact about a prize without prior entry.

PCH will never:

- Ask for payment of taxes, fees, shipping, insurance, or any expenses to claim the prize.

- Request money via any method.

- Ask for sensitive data, including financial information, to confirm a prize notification.

- Contact winners in advance by phone, email, or social media about major prizes.

What a real PCH win looks like

Legitimate PCH prizes follow a secure, verifiable process designed to protect winners and prevent fraud.

- Major prizes (SuperPrizes): Winners receive in-person visits from the official PCH Prize Patrol, with balloons, flowers, and a check, just as shown in PCH’s commercials. There is no prior notification by phone, email, or social media.

- Smaller prizes (usually under $10,000): Winners are notified by overnight delivery (UPS, FedEx), certified mail, or email for online giveaways.

- Prize affidavit: For prizes over $600, winners must complete and notarize a Sweepstakes Winners Affidavit of Eligibility within 30 days to claim the prize. Failure to do so results in prize forfeiture.

What to do if you’ve been targeted by a PCH scam

When someone is targeted by a PCH scam, certain steps can help limit financial loss and reduce the risk of identity theft.

- Stop all contact immediately: Continued replies, phone calls, link clicks, QR code scans, or other forms of engagement can give scammers additional opportunities to request money or collect personal information.

- Don’t send money or personal information: Legitimate sweepstakes don’t require follow-up payments or verification data after notification.

- Don’t spend funds from fake checks: In fake-check schemes, deposited funds may appear temporarily available due to standard banking processing rules. When the check is later determined to be fraudulent, the credited amount is reversed, and any money spent is typically recovered from the account holder, sometimes with additional bank fees.

- Contact your bank or payment provider: When money has been sent or a check deposited, financial institutions and payment services are often notified so the transaction can be documented or reviewed. These organizations may outline required steps, request supporting documentation, or explain whether recovery is possible. In some cases, a police report is requested.

- Save evidence of the scam: Communications and materials linked to the scam (such as emails, text messages, envelopes, screenshots, phone numbers, payment receipts, and URLs) are commonly preserved for fraud reports, financial reviews, or identity-related follow-up.

- Secure personal and financial identity: If sensitive data has been shared, identity-protection measures such as fraud alerts or credit freezes are frequently used to reduce the risk of unauthorized accounts, loans, or transactions.

- Report to the relevant authorities: Impersonation scams using the PCH name or branding should be reported directly to the Federal Trade Commission (FTC), which aggregates reports for enforcement and consumer-protection purposes.

Where and how to report scams

When a scam attempt is identified, reports can be submitted through official government and law enforcement channels. These reporting systems are used to track fraud patterns, support investigations, and, in some cases, guide recovery efforts related to financial loss or identity theft.

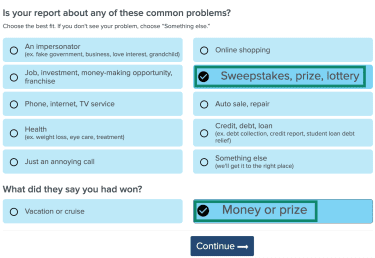

Report to the FTC

As already mentioned, PCH directs all consumers to report scams directly to the FTC, the official U.S. government agency responsible for tracking and taking action against fraud. To report the scam, visit the FTC’s Report Fraud page, select Sweepstakes, prize, lottery, and Money or prize, then click Continue.

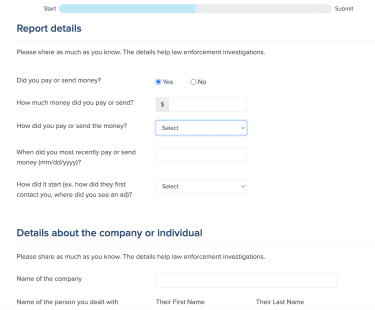

The form requests detailed information about the incident, including whether money was sent, the payment method used, and any known details about the scammer or communication channel. A free-text field near the end of the form allows for a full description of the scam and a chronological account of what occurred. After completing the form and clicking Continue, the report is submitted. Once submitted, the system displays a confirmation page with a report number and an option to view or preview the report for records.

Once submitted, the system displays a confirmation page with a report number and an option to view or preview the report for records.

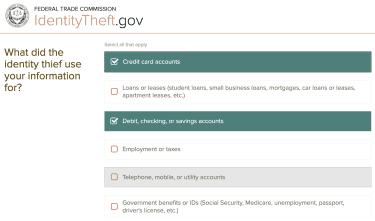

Report to IdentityTheft.gov

If personal information was shared (such as bank details, Social Security numbers, or government-issued identification), the incident can also be reported through the Identity Theft website, the federal government’s official identity-theft recovery portal.

The reporting process begins by selecting Get Started on the homepage and answering a series of prompts describing what information was exposed and how it may have been misused.

Based on these responses, the system transitions into the FTC form, where more detailed information about the incident is collected. This combined process generates a tailored identity-theft report and recovery plan.

Report to the IC3

If the scam involved online contact, digital communications, or electronic payments, a complaint can also be submitted to the FBI’s Internet Crime Complaint Center (IC3), which handles cyber-enabled fraud.

Reports are filed by selecting File A Complaint on the IC3 website, accepting the terms and conditions, and completing the online form. The form collects information about how the scam occurred, how contact was initiated, and whether financial transactions were involved.

After submission, a confirmation page is displayed. This page must be saved or printed immediately, as copies are not sent by email.

Report phishing emails and text messages

Phishing emails can be forwarded to the Anti-Phishing Working Group (APWG) at reportphishing@apwg.org. APWG is an industry consortium that collects phishing data and shares it with security vendors, internet service providers, and law enforcement agencies.

Phishing text messages can be reported by forwarding the message to SPAM (7726). This shortcode is used by major U.S. mobile carriers to investigate and block scam and phishing numbers.

How to avoid Publishers Clearing House scams

Here’s a handy checklist to sum up:

- Verify prize notifications by checking official PCH websites or contacting their official customer service directly.

- Do not trust caller IDs, links, or phone numbers provided in unsolicited calls, texts, or emails without independent verification.

- Use phone and email spam filters to reduce exposure to scam attempts.

- Know that legitimate PCH notifications never require advance payments, fees, or sensitive personal information to verify a win.

- Research unfamiliar senders or phone numbers online to find scam reports or warnings.

- Consult trusted resources like the FTC website for up-to-date information on common scams.

- Keep software, browsers, and security programs updated to protect against malware from phishing links.

- Avoid clicking on links or scanning QR codes received unexpectedly in messages about prizes or sweepstakes.

FAQ: Common questions about PCH scams

How does PCH notify legitimate winners?

Publishers Clearing House (PCH) notifies major prize winners in person through the Prize Patrol without advance notice. For smaller prizes, it notifies winners by overnight courier services, certified mail, or email.

Can I win a prize from PCH without entering a sweepstakes?

No, legitimate prizes are awarded only to those who have an entry associated with their name. Unsolicited texts or emails claiming that you’ve won are all signs of a scam, especially when you never entered a giveaway.

Is it safe to give my personal info to PCH?

Providing personal information to Publishers Clearing House (PCH) is generally safe when done through their official, secure channels. However, it’s important to ensure that any communication or website requesting personal details is genuinely from PCH to avoid scams. Always verify contact information and avoid sharing sensitive data through unsolicited calls, emails, or messages.

Can PCH call or text me directly?

Publishers Clearing House (PCH) does not call or text people to notify them that they’ve won a prize. Unsolicited calls, texts, and any outreach through social media are common scam tactics.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN