Best credit monitoring service: Protect your credit and identity

Your credit is more than just a number: it’s the key to getting loans, buying a home, obtaining insurance, or even landing a job. Unfortunately, it’s also a prime target for identity thieves. A single fraudulent account or stolen Social Security number (SSN) can create problems that are difficult and time-consuming to fix.

This is exactly why credit monitoring services exist. They act like an early warning system, alerting you when something suspicious shows up on your credit reports. The best identity protection services go further, scanning the dark web for your personal details, reaching out to data brokers to remove your information, and offering extra tools to safeguard your identity.

But here’s the big question: are these services really worth it? And if so, which ones give you the most value? In this guide, we’ll break down what credit monitoring actually does, why it matters, and what to look for when choosing the best credit monitoring service for your needs.

Please note: This information is for general educational purposes and not financial or legal advice.

What is credit monitoring?

Credit monitoring is the process of keeping track of your credit reports to spot errors or suspicious activity that could signal identity theft. Some services also track your credit score, alerting you to sudden drops that could be linked to fraudulent accounts or inaccurate late payments.

While you can monitor your credit on your own by requesting free reports from the three main credit bureaus (Experian, Equifax, and TransUnion) every week through AnnualCreditReport.com, checking regularly and combing through every detail can be time-consuming.

Dedicated credit monitoring services automate the process, continuously watch your reports, and alert you if something looks unusual.

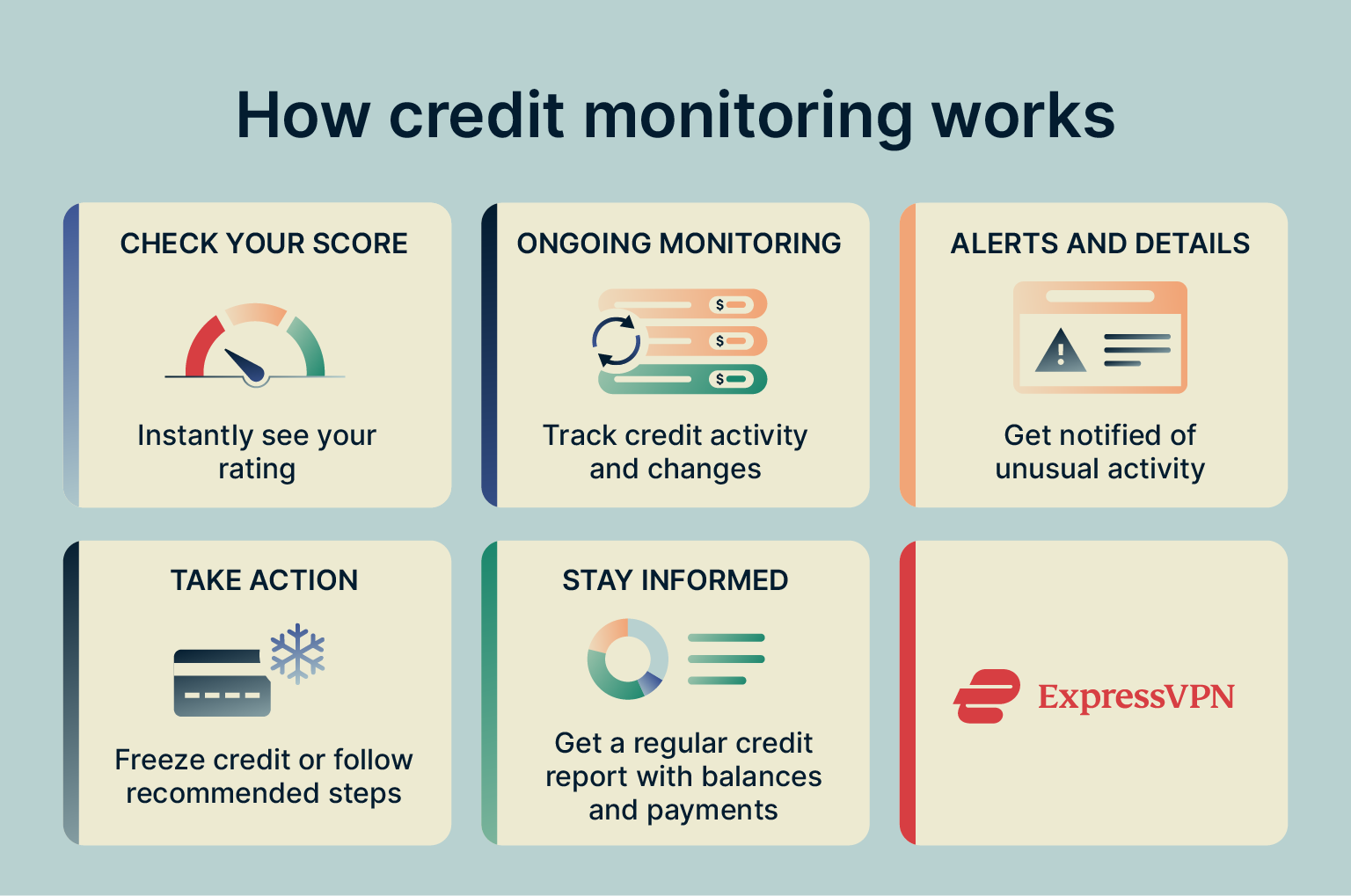

How credit monitoring works

Credit monitoring works by scanning your credit reports for suspicious changes. Most services connect to one or more of the major credit bureaus to give you visibility into your credit history. Monitoring services look for red flags such as:

Monitoring services look for red flags such as:

- Your credit card balance going over the limit.

- A new address being linked to your credit profile.

- Your accounts are behind on payments.

- A new credit inquiry.

- Sudden changes in your credit score.

- A public record of bankruptcy.

When something suspicious appears, you’ll get an alert. From there, it’s important to take action, whether by disputing the error with the credit bureau or, if you suspect internet fraud, freezing your credit and reporting identity theft. Acting quickly helps limit the damage.

The role of credit reports and scores

Credit monitoring services use your credit report and score to spot unusual changes quickly, helping you detect potential fraud earlier.

Your credit report lists the accounts you’ve opened, such as student loans, credit cards, car loans, and mortgages. It also shows inquiries into your credit (both hard and soft checks) and tracks your payment history, including late payments and collection accounts.

Your credit score condenses all that information into a single number that reflects the overall health of your credit. Because it reacts quickly to changes, your score is often the first sign that something isn’t right before you look deeper into the report itself.

Together, your credit report and score help monitoring services flag potential fraud. For example, if your score suddenly drops, that could mean new accounts were opened in your name, possibly by an identity thief.

The good news is that monitoring services don’t need access to your actual financial accounts (like your credit cards or mortgage) to monitor for these changes. They only pull from your credit report and request your score from the credit bureau, so your financial data remains protected.

However, it’s still important to choose a reputable credit monitoring service, since credit reports contain a lot of sensitive information, and you want to make sure it’s in safe hands.

Why early fraud detection is critical

Identity thieves can do a lot of financial harm in a short time:

- Taking out new loans in your name: A fraudster could take out a personal loan, auto loan, or even a mortgage using your stolen identity.

- Opening new lines of credit in your name: Identity thieves may use your personal information to apply for new credit cards or lines of credit. Once approved, they can quickly run up charges or take cash advances.

- Insurance-related problems: If an identity thief uses your information to obtain medical, car, or home insurance and files fraudulent claims, it could complicate your legitimate claims or raise red flags with insurers.

- Credit access challenges: Identity theft can harm your credit score, which may make it harder to qualify for favorable loan terms, lower insurance rates, or higher credit limits.

Credit bureaus recommend that you check your credit reports at least once a year, but if you wait that long, you might not catch fraud until the damage is done.

Why do you need a credit monitoring service

A trustworthy credit monitoring service can be a powerful tool to help protect you from identity theft and prevent long-term damage to your credit. Here’s why:

- Alerts for suspicious activity: Get timely notifications if something unusual shows up on your credit.

- Identity theft prevention and recovery: By alerting you to suspicious activity, credit monitoring services give you the chance to respond early and reduce the impact of identity theft.

- Ongoing credit score tracking and insights: Some services offer tips that may help you strengthen your credit profile, which could make it easier to qualify for better terms on major purchases.

How the best credit monitoring services protect you

There are plenty of credit monitoring services out there, but they don’t all offer the same level of protection. Here’s what the best ones provide:

Bureau credit monitoring

Credit monitoring services work by pulling your credit report from one or more of the major credit bureaus: Equifax, TransUnion, and Experian. This lets them track changes in your credit history, such as new accounts, payment history updates, or inquiries.

Even if a service monitors just one bureau, it can still provide meaningful protection. Because many lenders report to more than one bureau, single-bureau monitoring is often enough to catch key changes and alert you to possible fraud.

The main benefit of bureau monitoring, whether from one bureau or all three, is that it acts as an early warning system, helping you respond quickly if suspicious activity appears.

Dark web and privacy scans

Dark web scans are usually offered as part of broader identity theft protection services, separate from standard credit monitoring. They help you find where sensitive personal information (such as your SSN, bank accounts, or credit card numbers) may be circulating on the dark web.

Your data may leak to the dark web in multiple ways; for example, if a company you’ve shared personal information with (like a tax preparer) suffers a data breach. Without a dark web monitoring tool, you might not know this, leading to different types of identity theft.

Some identity theft protection plans also include privacy scans, which look for your personal information on data brokers and people-search sites. These are equally valuable, since cybercriminals often piece together data from multiple sources to commit fraud.

It’s important to set your expectations of what these services can do for you correctly. Dark web monitoring and privacy scans can’t stop your information from leaking. What they can do is alert you early so you can take action, such as changing compromised credentials or reporting identity theft, before more damage is done.

Fraud insurance and legal support

While credit monitoring can alert you to suspicious activity, full identity theft protection services often go a step further by offering insurance and recovery support if you ever become a victim of identity fraud.

Identity theft insurance may include:

- Expense reimbursement: Covering loss resulting directly from the misuse of your stolen information, as well as the expenses and legal costs you incur while trying to restore your identity.

- Identity restoration services: Guidance and step-by-step instructions you can follow to repair and restore your identity.

As with any insurance, it’s important to read the fine print so you understand exactly what’s covered.

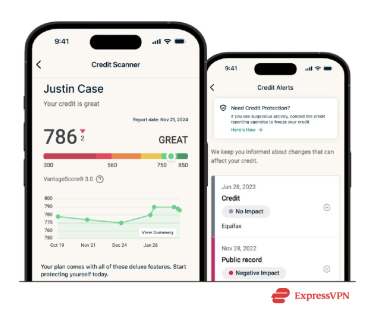

All-in-one protection with ExpressVPN’s Credit Scanner

ExpressVPN’s Identity Defender suite brings these protections together in one package. It combines credit scanning, dark web monitoring, and data broker removal services with the privacy and security of ExpressVPN. With Credit Scanner, you can:

With Credit Scanner, you can:

- Check your Experian credit score and rating instantly inside the ExpressVPN app.

- Get credit monitoring alerts when new activity appears that could impact your report.

- See what’s affecting your score, with details and recommended actions to help you improve it.

- Access key protection information if you ever need to freeze your credit quickly.

- Receive monthly reports that summarize your accounts, balances, and payments.

Identity Defender also includes:

- ID Alerts, which scan for unauthorized changes of address, dark web exposure, and suspicious SSN activity, sending you prompt notifications so you can respond before fraud escalates.

- Data Removal, which searches data brokers and people-search sites for your personal details and handles opt-out requests on your behalf, helping to reduce spam, unwanted solicitations, and the risk of identity theft. For those in the U.S., there’s also a free tool that shows which data brokers and people search sites have your data.

- ID Theft Insurance, which reimburses eligible expenses up to $1 million* if your identity is fraudulently used.

Best credit monitoring service: Free vs. paid options

You can find both free and paid credit monitoring services, but the level of protection they provide differs significantly. Free tools may sound appealing, yet their limitations can leave big gaps in your defenses. Paid services, on the other hand, are designed to give you broader coverage, faster alerts, and extra safeguards that help you act before fraud spirals out of control.

What you get for free

Free credit monitoring usually comes with a narrow scope. You might receive occasional credit alerts, but they’re often delayed or less detailed. Most free plans also skip dark web scans, so your SSN, tax ID, or bank details could circulate online for months without your knowledge.

Other useful tools are often missing too, such as data broker removal services. These are important because fraudsters don’t always need a dark web dump. Many can piece together your personal information from publicly available databases. Free services also don’t cover the costs of identity restoration, leaving you to pay out of pocket if you fall victim to identity theft.

Benefits of paid protection

Paid services go beyond the basics. They actively monitor your credit reports, track your credit score, and scan the dark web for leaked personal information. More importantly, they deliver timely alerts.

Premium plans typically bundle in identity protection extras:

- Identity theft insurance covering recovery expenses.

- Data broker removal to reduce your digital footprint and limit exposure.

- Privacy and security add-ons, such as virtual private network (VPN) access, which strengthen your defenses on multiple fronts.

The cost-to-benefit ratio is also compelling. Over years of use, the price of a paid plan is a fraction of what you might spend dealing with identity theft on your own. Instead of manually checking your credit reports and risking fatigue (or worse, missing crucial signs), you can outsource the work to a service built to monitor nonstop.

Is a premium service worth the price?

Many people find that continuous monitoring, combined with the extras included in paid plans, provides peace of mind. It’s important to review what each service offers and ensure it fits your needs and budget. Features like strong identity safeguards, fast alerts, and recovery support may make premium protection appealing if you want broader coverage.

ExpressVPN’s Identity Defender is included for free with select plans for U.S. customers, giving you access to credit monitoring, identity monitoring services like dark web scans, insurance*, and other identity theft protection features at no additional cost.

How to get started with credit monitoring

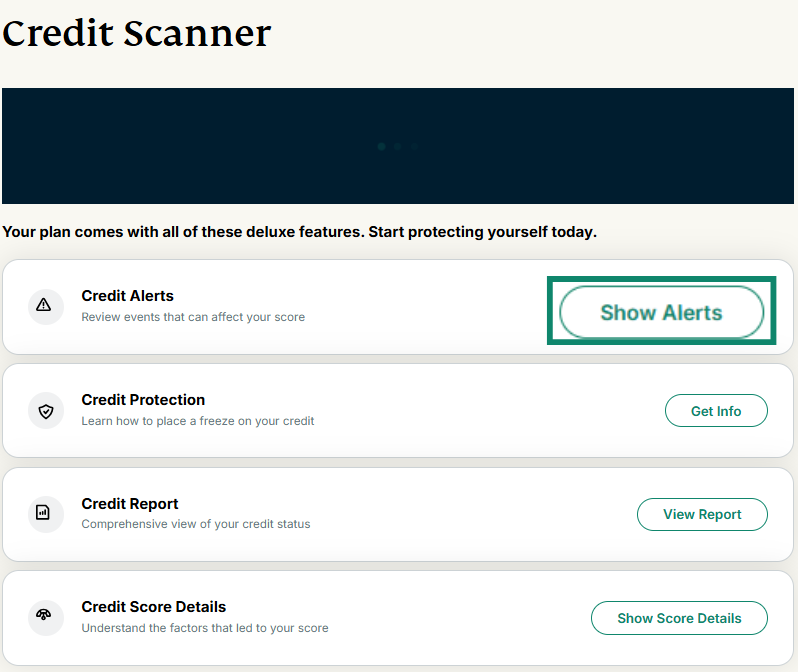

How to set up and use ExpressVPN’s Credit Scanner

You can set up Credit Scanner through the ExpressVPN mobile app on iOS or Android, or directly from your ExpressVPN Account page.

- Go to the ExpressVPN order page.

- Choose a preferred subscription. If you’re in the U.S., Advanced comes with Credit Scanner, ID Alerts, and ID Theft Insurance*. The Pro plan additionally offers Credit Report and Data Removal.

- Complete the checkout process.

- Log into your ExpressVPN account.

- Set up Identity Defender inside the app.

- On mobile, open the ExpressVPN app and go to Add-ons > Credit Scanner.

- On desktop or browser, sign in to My Account on the ExpressVPN website and select Credit Scanner.

- Follow the setup prompts and enter the required information so the service can monitor your credit. All data is handled securely under the Identity Defender Privacy Policy.

Monitor and review your reports regularly

Your alerts and reports won’t be as useful if you never review them. While the credit monitoring tool handles most of the work, it’s still important to check the reports and insights it provides so you can take action when needed. For instance, Identity Defender may notify you of your login information showing up on the dark web. However, it can’t change the compromised information on the affected accounts for you.

For instance, Identity Defender may notify you of your login information showing up on the dark web. However, it can’t change the compromised information on the affected accounts for you.

Learn more: Read our detailed guides on personal data removal laws, Google’s personal data removal tools, and how to delete yourself from the internet.

FAQ: Common questions about credit monitoring services

Does credit monitoring hurt my credit score?

Credit monitoring doesn’t hurt your credit score. Credit monitoring checks typically appear as soft inquiries on your credit report or sometimes don’t appear at all.

How often should I check my credit?

It’s best to check your credit regularly to catch suspicious activity early. Since most people don’t have time for such frequent, detailed checks, a reliable credit monitoring service like ExpressVPN’s Credit Scanner can help fill the gap.

Can credit monitoring improve my credit score?

Credit monitoring itself won’t raise your credit score. However, some tools provide insights and tips to help you improve it, and applying those strategies could lead to positive changes over time.

Is ExpressVPN’s Credit Scanner a good credit monitoring option?

Yes. ExpressVPN’s Credit Scanner monitors your credit history and provides timely alerts about suspicious activity. It’s also part of the broader ExpressVPN Identity Defender suite, which includes dark web monitoring, data removal, and identity theft insurance* for more comprehensive protection.

Is credit monitoring the same as identity theft protection?

Credit monitoring isn’t the same as identity theft protection. While it can catch some signs of fraud, it won’t detect issues like tax, criminal, or synthetic identity theft. Broader tools, such as ExpressVPN Identity Defender, add features like dark web monitoring to give you stronger protection.

*The insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under group or blanket policies issued to Array US Inc, or its respective affiliates for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN