How to avoid Zelle scams and protect your money

Zelle is a popular payment option for sending money quickly and conveniently to people you know. Unfortunately, scammers also operate on Zelle, using various tricks and techniques to deceive users into giving away their money or even their identities. This guide explores the various forms of Zelle fraud and how to avoid it.

What are Zelle scams?

A Zelle scam is when deceptive and fraudulent tactics are deployed to trick users of the Zelle payment platform into authorizing payments or sharing personal, sensitive information. Scammers can do this via various means, from impersonating friends or bank employees to making up claims about their victims winning lottery prizes or other rewards.

Why Zelle is a target for scammers

There are two main reasons why scammers like to operate on Zelle:

- Instant, irreversible payments: Payments made through Zelle are almost instantaneous and can’t be reversed by Zelle, so if a scammer can trick someone into sending money, they’ll get it right away.

- Trust and popularity: Zelle is integrated into many online banking platforms and is a popular, trusted service. This gives scammers a broad pool of potential victims to target compared to less popular platforms.

The psychology behind Zelle scams

Many Zelle scams work by building a sense of trust or confidence between the victim and the scammer.

The scammer might pose as a friend, family member, or figure of authority, like a Zelle employee, to develop that sense of trust. Or they might pretend to be a legitimate buyer or seller of a product or service, wishing to use Zelle to conduct a transaction.

Alternatively, they might play on the victim’s emotions by using language that builds a sense of urgency or pressure. This often results in a situation where the victim feels compelled to make quick decisions without fully thinking them through.

How Zelle scams work

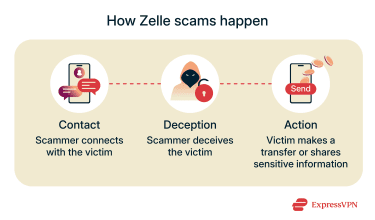

There are various types of Zelle payment scams, but all tend to follow a familiar pattern, as outlined in the steps below.

Step-by-step fraud process

- Initial contact: First, the scammer must establish contact with their victim. They can do this via various means, including text messages, emails, or calls.

- Deception: Next, the scammer deceives the victim in some way, either to build trust or exert pressure on them. This might include impersonating someone they trust or sharing false claims about their account.

- Transfer: If the scammer is able to deceive their victim, they can eventually push them into either transferring funds to the scammer’s account or giving up personal data, like their online banking credentials.

Red flags to watch for

- Sense of urgency: Scammers often try to pressure their victims into making mistakes or acting before thinking. Their messages may make you feel that you need to act immediately, either by sending money or making changes to your account.

- Typos or grammatical mistakes: Scammers don’t always take the time to proofread their phishing messages. You might, therefore, notice some little mistakes in their communications. Zelle and banks don’t tend to make those kinds of errors.

- Suspicious links: Trusted banks and payment platforms won’t usually text or email you asking you to click a link to make a payment or update your account. Scammers, however, often deploy links as part of their social engineering schemes.

- Unexpected or unsolicited requests or payments: Be wary of any messages you didn’t expect or request that claim to come from your bank, Zelle, or people you know.

Common types of Zelle scams and fraud

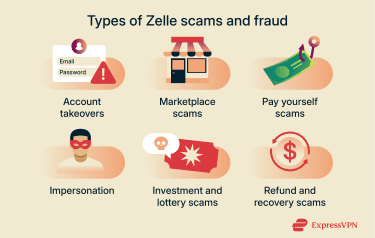

Below are the most common types of Zelle-related scams and fraud to watch out for.

Account takeovers

A Zelle account takeover is when a fraudster attempts to gain control of your Zelle account, often with the intention of using it to transfer funds to other accounts they own. To do this, they need to acquire your login credentials, which they can try to do via phishing or social engineering techniques.

They might send a fake text or email that seems to be from either Zelle or your bank, for example, suggesting that there’s some sort of problem with your account. The message might ask you to click a link and log in to protect your funds, but the link actually takes you to a fake site where you may inadvertently give away your credentials to the attacker.

Marketplace scams

Many peer-to-peer payment scams start off on online marketplaces, like Facebook Marketplace or Craigslist, where buyers or sellers might offer to use Zelle as a way to pay for goods or services.

Buyers might send you fake Zelle confirmation emails or screenshots, or pretend to have “overpaid” you and ask you to send part of the money back. In reality, they haven’t sent any cash at all, and you’ll be losing out if you send them anything.

Sellers might claim to offer high quality goods at low prices, enticing you to pay for them via Zelle, but then not actually sending you anything.

Red flags of marketplace scams include pressure to use Zelle, outright refusal to use any other payment options, “too good to be true” prices or offers, or buyers/sellers who send screenshots of Zelle payments that don’t match what it says on your bank statements.

If you’re paying someone you don’t know or can’t fully trust, or if there’s a risk you won’t receive what you paid for, a credit card is often the safer option. Many credit card issuers offer built-in buyer protections, such as the ability to dispute charges for non-delivery or items that aren’t as described. Zelle, by contrast, does not offer a buyer protection program for authorized payments. Because of this, Zelle is best used only for sending money to people you know and trust, not for marketplace purchases or one-off transactions with strangers.

Pay yourself scam

This often starts with a fake fraud alert message from your bank or a call from the Zelle “fraud department,” claiming that your account is compromised and asking you to verify your identity.

They might ask you to send a payment to yourself, but actually end up paying the scammer. In reality, Zelle will never ask you to pay yourself to verify an account or your identity.

Impersonation scams (friends, family, bank)

Zelle impersonation scams involve scammers sending messages pretending to be someone you know or trust, such as a friend, family member, or even a bank employee. They might pretend to be a relative in trouble, urging you to quickly send them money, or claim to be a Zelle or bank representative, warning you about a problem with your account.

Similar tactics are used on other platforms, like Amazon, and some of these scams can be quite elaborate. Scammers might hack into social media profiles of people you know and trust, or make fake profiles to fool you before asking for money. It’s important to be very wary of messages you receive out of the blue asking you for emergency funds or assistance.

Investment and lottery scams

Many Zelle scams revolve around “too good to be true” claims. Scammers might, for example, lure victims in with the promise of amazing investments that are allegedly guaranteed to provide huge returns for minimal risk. Or, they might claim that the victim has won a lottery or other prize, asking them to pay some sort of tax or fee to unlock their winnings.

They may claim, for example, that you just need to make an initial investment payment or cover a few hundred dollars of admin charges, promising that you’ll receive much more back than you invest. In reality, once you make the initial payment, scammers will often disappear with your money.

Refund and overpayment scams

Refund and overpayment scams revolve around unexpected payments suddenly arriving in your account. The sender will then message you, claiming to have made a mistake and asking for the money back. Many people will feel guilty or concerned and want to do the right thing, refunding the original payment.

In reality, the scammer may have used a stolen account to make their original payment. The real account holder may eventually regain control of their account and get their money refunded. So, if you refund the fake payment, you may end up losing your “refund,” plus the original money that entered your account.

How to avoid Zelle scams

Knowing about the various types of Zelle scams is an important first step in avoiding them. But there are several more ways in which you can safeguard your account, funds, and identity and reduce your risk of becoming a Zelle scam or fraud victim.

Best practices for Zelle users

- Only pay people you trust: Zelle is designed for sending money to people you know and trust, like friends and family, not strangers. If you need to pay someone you don’t know, opt for an alternative payment platform with payment protection built in.

- Monitor your account: Check your online banking statements and accounts on a regular basis to look for any suspicious signs, like transactions you don’t recognize or unusual login attempts.

- Never send money to yourself: There’s no reason you should need to send any money to yourself, so don’t believe any messages or calls that urge you to do so.

- Use strong passwords and two-factor authentication (2FA): This helps protect you from account takeovers that rely on brute force attacks or phishing.

Recognize psychological traps

Scammers will often try to pressure you or use emotional, intimidating, or even threatening language to pressure you into paying them quickly. Don’t fall victim to these tricks. Real friends, family members, Zelle representatives, and bank employees should not pressure you in this way. Always take your time and verify details before sending a payment, and if you have any doubts or suspicions, don’t proceed with the transaction.

What to do if you’ve been scammed

If you suspect you’ve been the victim of Zelle transfer fraud, it’s important to stay calm but act quickly. Reporting the scam to the relevant authorities and taking proactive steps to safeguard your money and identity should help you limit the impact of the scam.

Report the scam to your bank

The first step is to contact your bank or financial institution. You may be able to speak with their fraud team directly or call a general helpline and explain the situation. Your bank should be able to take immediate steps to prevent further problems, such as freezing your account to prevent the scammer from taking any more money out of it, or refunding unauthorized transactions.

If you’re in the U.S., other authorities that are worth contacting include the Federal Trade Commission (FTC) and the Internet Crime Complaint Center (IC3). You can also file a police report, as well as contacting Zelle’s support team, too; Zelle won’t be able to refund your money, but it may be able to use any information you provide to identify the scammer.

Freeze your credit

If you’ve shared any sensitive information with the scammer, freezing your credit should help to stop them from stealing your identity or opening accounts or loans in your name. Contact the three major credit bureaus (Experian, Equifax, and TransUnion) to request a credit freeze.

Update your credentials

If you suspect a scammer may know your password and have access to your account, it’s important to update your Zelle and online banking passwords immediately. You will also need to update your login details for any other accounts that use the same password.

Monitor your accounts

Keep a close eye on your bank accounts and emails in the days following the scam to look for any suspicious signs, like transactions you don’t remember making or attempted logins from other devices and locations. If you spot anything strange, report it.

Can you get your money back?

Like other payment services, Zelle makes a clear distinction between fraud and scams, and that distinction matters when it comes to refunds. Fraud generally refers to payments you didn’t authorize, while scams involve payments you approved yourself after being misled.

If money was sent through Zelle without your authorization, such as in an account takeover where someone accessed your bank account or Zelle profile without permission, the transaction is typically treated as fraud. In these cases, your bank or credit union is required to investigate and may reimburse you, depending on the circumstances and how quickly you report it.

However, if you authorized the payment yourself, even if you were tricked or pressured into doing so, getting your money back is much less likely. Zelle does not offer a buyer or purchase protection program for authorized payments, and transactions generally can’t be reversed. Some banks may reimburse losses in limited cases, such as certain impersonation scams, but this isn’t guaranteed and depends on your bank’s policies.

FAQ: Common questions about Zelle scams

How can I tell if someone is scamming me with Zelle?

Some of the common signs of a Zelle scam include someone pressuring you to pay them or take some sort of action very quickly, or suspicious, recurring messages that seem to come either from Zelle or your bank (or both). “Too good to be true” offers are also often signs of Zelle scams, like claims of lottery wins or sellers offering luxury goods for suspiciously low prices.

Is it safe to accept Zelle payments from strangers?

Generally speaking, no, Zelle is designed for sending and receiving money with friends, family, and other people you trust, not strangers. Scammers can sometimes use stolen accounts to send money to their victims or claim to have overpaid and ask the victim to send them a refund. In short, accepting Zelle payments from strangers can be a slippery slope, so it’s best avoided.

What are signs of a Zelle scam?

Signs of a Zelle scam include urgent requests for money, promises of “too good to be true” deals or rewards, or messages that claim to be from friends, family, or Zelle employees, urging you to send funds somewhere or make changes to your account. It’s important to note that neither Zelle nor your bank will ever send messages asking you to send money anywhere.

What if someone sends me money I didn’t ask for?

If someone sends you money on Zelle that you weren’t expecting and didn’t ask for, don’t send it back right away, as it may be part of a scam. The funds may be coming from a stolen account, for example. You should report the account that sent you the money to Zelle and contact your bank to let them know what happened, so they can investigate further.

Who do I report Zelle scams to?

You should contact your bank or financial institution first, letting them know exactly what happened. They may be able to help by freezing your account or refunding any unauthorized transactions. You can also report scams to Zelle directly, as well as other authorities, like the Federal Trade Commission (FTC) and Internet Crime Complaint Center (IC3).

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN