Employment identity theft: What it is and how to protect yourself

When someone steals your identity to get a job, the damage can go far beyond your credit report. It might lead to unexpected notices from the Internal Revenue Service (IRS), errors in your employment history, or even complications when applying for a new role. And in many cases, victims don’t find out until much later, when the consequences have already started piling up.

This guide breaks down what employment identity theft really is, how it happens, and what steps you can take to detect it early and respond effectively. Whether you're a job seeker, an employee, or an employer, understanding the risks can help you protect both your career and your personal information.

Please note: This information is for general educational purposes and not financial or legal advice.

What is employment identity theft?

Employment identity theft happens when someone uses your personally identifiable information, like your full name or Social Security number (SSN), to get a job, collect wages, or pass a background check, often resulting in fraudulent employment records.

It’s not always easy to detect employment identity theft. You might only find out after getting an unexpected IRS notice, spotting wage errors, or discovering a false job history tied to your name.

Learn more: Read our detailed guide about identity theft.

Why does employment identity theft happen?

There are several reasons why someone might commit job identity theft. For example, a person with a disqualifying felony conviction might use someone else’s identity, particularly one with a clean criminal record, to qualify for a job they wouldn’t otherwise be eligible for.

In other cases, individuals may try to receive wages or benefits using someone else's SSN, which can result in fraudulent employment records and confusion during tax filing.

The motivation behind this type of workplace identity theft is often to pass background checks, get hired, and avoid detection, leaving the real person to deal with IRS employment fraud or employment record inaccuracies.

How does employment identity theft occur?

Employment identity theft usually starts when someone gains access to your personal data.

How thieves steal your information

There are several ways identity thieves get hold of personal data and use it to commit employment-related fraud:

- Phishing scams that trick you into sharing personal details by pretending to be from a trusted source.

- Fake job postings or offers that collect real applicant data for fraudulent use.

- Data breaches that expose employee records stored by employers or third-party systems.

- Theft of documents like tax forms or identification that contain sensitive information.

- Misuse of internal access, where someone with authorized access to data uses it improperly.

Victims often don’t realize what’s happened until they receive an IRS identity theft notice, spot a wage reporting error, or encounter a discrepancy during a job application background check.

Common employment fraud methods

Once a thief has enough of your personal information, they can use it in several ways to commit workplace identity theft. These actions are designed to make the person appear legitimate to employers, payroll systems, or government agencies, even though they’re using someone else’s identity. Here are some of the most common methods:

Here are some of the most common methods:

- Submitting fake job applications using stolen personal and employment information.

- Fabricating employment records and false work histories in another person’s name.

- Using a stolen SSN to be added to payroll and collect wages.

- Passing background checks by providing someone else’s identity and credentials.

- Filing unemployment or workers’ compensation claims under another person’s identity.

These methods can affect everything from your tax status to your future job opportunities. If left unresolved, it can lead to tax return issues due to employment fraud, delayed benefits, or questions about your work history.

Learn more: Find out if someone can steal your identity with your ID.

Common targets of employment identity theft

Employment identity theft can affect anyone whose personal information is exposed. In many cases, the data is taken from systems that store employee records or application forms.

Job seekers who post their résumés online are often targeted. Identity thieves can collect email addresses, phone numbers, and other personal details directly from résumé databases on major job platforms. Some even create fake job listings to trick applicants into sharing SSNs, bank details, or other sensitive information under the pretense of doing background checks.

Remote work has also made it easier for identity thieves to operate undetected. In some schemes, overseas workers have used stolen identities to land remote jobs at U.S. companies. Sometimes, insiders even helped coordinate the fraud by handling company laptops and payments.

Certain groups tend to be more vulnerable than others, whether because of age, income level, or how much personal information they share online. People between 30 and 39 report the highest number of identity theft cases, but they’re not the only ones at risk. High earners and heavy social media users are also common targets, since their online presence and financial activity give criminals more data to exploit.

Even children can become victims, especially when their SSNs go unused for years, allowing fraud to go undetected. Sometimes, the person misusing their identity is a parent or someone close.

Signs of employment identity theft

Employment identity theft can be difficult to detect at first. Unlike financial fraud, it doesn't always leave obvious traces like unauthorized charges.  Here are some common red flags to watch for:

Here are some common red flags to watch for:

- You receive a letter from the IRS about income you didn’t earn, especially from an employer you don’t recognize.

- You receive a CP01E notice or mismatch letter from the IRS, indicating a discrepancy between the income reported by an employer and what you filed on your tax return.

- Your tax refund is delayed or flagged due to suspected IRS employment fraud.

- Your Social Security benefits are denied because of earnings or claims that don’t match your record.

- You see a wage reporting error on your Social Security statement for jobs you never held.

- You’re contacted about a background check from a company you never applied to.

- You receive job offer letters, onboarding paperwork, or emails from unfamiliar employers.

- You get mail from unemployment agencies about claims you never filed.

Real-world examples of employment identity theft

These real cases show how job identity theft happens in practice. From using stolen SSNs to faking employment records, the impact can be serious for both victims and employers.

Stolen U.S. identities used by workers in North Korea for remote jobs

Between 2020 and 2023, Christina Chapman, a U.S. citizen from Arizona, helped IT workers in North Korea use stolen identities of at least 68 Americans to get hired at over 300 U.S. companies. These included tech firms, media companies, and even government contractors.

Chapman ran a so-called "laptop farm" from her home, receiving company laptops and making it look like the workers were based in the U.S. She also shipped some of the devices abroad to allow remote access. In total, the scheme generated over $17 million, much of which was falsely reported to the IRS and Social Security Administration (SSA) under the victims' names.

Woman posed as a registered nurse using someone else’s identity

In 2023 in Michigan, Leticia Gallarzo pleaded guilty to aggravated identity theft after using another person’s credentials to get hired as a licensed registered nurse. She applied for the job through a job platform, claimed to have a nursing degree, and submitted the identity of a real nurse to pass the employer’s checks.

Once hired, she evaluated patients and signed official medical records. Her work was tied to Medicare claims, which rely on staff being properly licensed. Gallarzo was never authorized to practice nursing and faces up to seven years in prison.

How employment identity theft affects you

When someone uses your personal information for work purposes by stealing your SSN, faking employment records, or applying for jobs in your name, the effects can ripple through your life in unexpected ways.

Financial consequences

If someone uses your identity to get a job, it can lead to serious financial issues, especially if their income gets reported under your name. You may receive tax forms for wages you never earned, get hit with an unexpected bill from the IRS, or even face debt collection tied to fraudulent employment.

These are some of the most common financial effects of employment identity theft:

- Tax complications: You might owe back taxes or penalties because the IRS believes you underreported your income.

- Loss of benefits: If someone else gets a job under your SSN, it may interfere with your eligibility for unemployment, disability, or retirement benefits.

- Debt collection: In rare cases, victims have been contacted by collectors about debts tied to fraudulent employment.

In some cases, these consequences can take months, or even years, to fully resolve.

Employment and legal issues

Employment identity theft doesn’t just affect your finances; it can follow you into the workplace or even the courtroom. If someone gets hired using your SSN or other personal details, it may leave a false employment history attached to your name. This can cause problems when applying for new jobs, especially if the impersonator had a poor performance, was fired, or committed fraud while “being you.”

Worse still, some victims have faced background check discrepancies or even criminal records linked to crimes committed by the identity thief. In these cases, some victims have required legal support to resolve record discrepancies.

Learn more: Read our detailed guide about criminal identity theft.

How to prevent employment identity theft

Employment identity theft often goes unnoticed until it causes real problems, like tax return issues, wage reporting errors, or unexpected background check discrepancies. But many of these risks can be avoided with a bit of awareness and a few preventative steps.

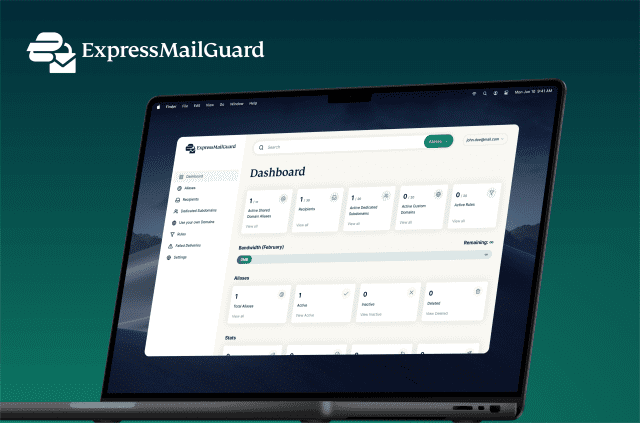

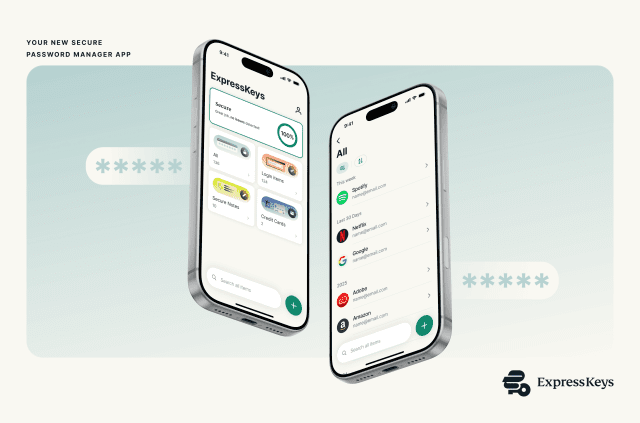

Whether you're protecting your own personal data or managing employee records within a company, understanding how work identity fraud happens is key to staying ahead of it. ExpressVPN’s Identity Defender (currently available to U.S. users) provides tools built specifically to help detect and respond to identity misuse, including cases of employment fraud:

- ID Alerts monitor for suspicious activity such as unauthorized address changes, misuse of your SSN, or personal data circulating on the dark web.

- Credit Scanner tracks your credit activity, making it easier to spot fraudulent accounts or suspicious loans opened in your name.

- Data Removal works to scrub your personal details from people-search sites and data broker lists, reducing the chances of criminals misusing them for employment scams. There’s also a free tool that shows U.S. users which data brokers and people search sites have their data.

- ID Theft Insurance offers financial protection of up to $1 million* if you do fall victim to identity theft. Insurance coverage is subject to specific terms, conditions, and eligibility requirements.

Smart steps individuals can take

To reduce the risk of employment identity theft:

- Keep your SSN private: Don’t carry your Social Security card in your wallet, and only share your number with trusted entities when absolutely necessary.

- Be cautious with job applications: Scammers sometimes post fake listings to collect personal data. Check that the employer and job platform are legitimate before applying.

- Watch for signs of misuse: IRS notices about unreported income or unfamiliar W-2 forms could indicate someone’s working under your identity.

- Monitor your credit reports: Check them regularly to catch employment-related fraud early.

- Use fraud alerts or a credit freeze: These are key processes if you suspect your information has been compromised.

How employers can protect employees

Businesses also face risks when employee identity theft slips through the cracks. A stolen SSN or fake credential used during hiring can expose a company to compliance issues, fines, or even legal consequences. To reduce that risk, employers can:

To reduce that risk, employers can:

- Verify all candidate credentials carefully, especially licenses or certifications tied to regulated industries.

- Use background checks and SSN validation services to confirm eligibility for work.

- Train HR staff to spot warning signs, such as mismatched documents or unusual employment histories.

- Consider offering identity theft protection as part of the employee benefits package; it can support early detection and faster recovery if someone becomes a victim.

It’s also worth reviewing how digital monitoring tools are deployed in remote work environments. Poorly secured employee surveillance software can create new openings for data leaks or misuse, increasing the risk of identity theft inside the workplace.

What to do if you’re a victim of employment identity theft

If employment identity theft happens, don’t ignore it. Here are some actions you can take.

Please note: This guide is for educational purposes only and should not be considered financial or legal advice. If you believe you are a victim of employment identity theft, consider contacting qualified legal or financial professionals alongside the consumer protection resources listed here.

Report the fraud

If you receive an IRS notice about income you didn’t earn or a tax form from an unknown employer, it may mean someone used your personal details to get a job. You can file an Identity Theft Affidavit (Form 14039) with the IRS to report the situation. This helps flag your account and prevent further misuse of your SSN.

You should also file a report with the Federal Trade Commission (FTC) and notify your local police department. Having a police report on file may be useful if you need to correct employment records or respond to collection notices.

It’s also important to notify the Social Security Administration (SSA). If your benefits are denied or adjusted because of unknown earnings, this could be a sign that someone is using your SSN for employment purposes.

Secure your credit

If your SSN has been misused for work purposes, it's important to secure your credit as soon as possible to prevent further harm. One of the first steps is placing a free, one-year fraud alert on your credit reports. This tells lenders to take extra steps to verify your identity before approving credit in your name.

You can contact any of the three nationwide credit bureaus, Equifax, Experian, or TransUnion, and the one you notify is required to alert the other two. You can also consider freezing your credit if you don’t plan to apply for new credit soon.

Contact employers

If you receive a W-2 or 1099 from a company you’ve never worked for, it may mean someone used your identity to get a job. When possible, reach out to the employer listed on the form and inform them that your identity was misused. This can help prevent further fraudulent activity and may assist the company in correcting their records.

Even if the employer cannot share details due to privacy rules, reporting the issue helps document the incident and may support future investigations by the IRS or other agencies.

Check your credit reports

If you suspect someone has used your identity for employment, review your credit reports for errors or unfamiliar activity. In the U.S., you’re entitled to a free credit report from each of the three major bureaus once a week through the official site. Spotting and disputing mistakes early can help limit the damage from identity theft.

But since checking manually can be time-consuming, tools like ExpressVPN’s Credit Scanner make it easier to keep an eye on your credit activity and catch signs of fraud sooner.

Employment identity theft statistics and trends

Identity theft remains a widespread problem, and it’s far from going away. In 2023, the FTC received over 1 million reports of identity theft in the U.S. alone. While not every case was employment-related, many involved stolen SSNs or government IDs, which can directly impact job records and tax filings.

In 2023, data breaches reached a record high, with over 3,200 incidents reported, which was a 78% increase compared to 2022.

With millions of personal records compromised, the risk of employment identity theft remains high. Criminals continue to exploit data leaked from banks, employers, and online platforms, using increasingly sophisticated tactics to impersonate job seekers or employees.

FAQ: Common questions about employment identity theft

Can employment identity theft affect my taxes?

Yes. If someone uses your Social Security number (SSN) to get a job, it can lead to tax issues. You might receive a W-2 from an unknown employer or a notice from the Internal Revenue Service (IRS) about unreported income. These red flags often mean that another person has used your identity to earn wages, which can result in tax discrepancies or delays in your refund.

How long does it take to recover from employment identity theft?

Recovery time can vary widely depending on how much damage was done and how quickly the fraud was discovered. Some victims manage to resolve the issue in a few months, while others may deal with complications for years, especially when tax issues, wage discrepancies, or benefit denials are involved.

Is employment identity theft the same as tax identity theft?

Not exactly. Employment identity theft happens when someone uses another person’s identity, like a Social Security number (SSN), to get a job. Tax identity theft, on the other hand, involves using stolen personal data to file false tax returns or claim refunds fraudulently. While they’re different, the two can be connected: unauthorized wages reported under your name can trigger tax issues with the Internal Revenue Service (IRS).

How often does employment identity theft occur?

Employment identity theft is a growing concern in the U.S. While not all identity theft cases involve jobs or wages, it’s a significant share of the problem. In 2023 alone, the Federal Trade Commission (FTC) received more than 1 million reports of identity theft.

What can I do if someone stole my identity to get a job?

Place a fraud alert with a credit bureau and check your Social Security earnings for errors. If the Internal Revenue Service (IRS) contacts you about wages you didn’t earn, you may need to report the incident and submit Form 14039 to flag tax-related identity theft.

*The insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under group or blanket policies issued to Array US Inc, or its respective affiliates for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN